Being listed in checkout is not the same as being chosen.

Across millions of webshops, delivery providers are technically present at checkout, but the way they are presented varies widely. Sometimes the carrier is not named at all due to white-label setups. Sometimes delivery methods are bundled or implicit. Often, delivery time is missing.

When that happens, consumers hesitate or default to another option. And as agentic e-commerce will partly move checkout decisions towards automation and agent-driven flows, delivery options that are not clearly defined are even more likely to be skipped.

This is the problem the Checkout score is built to address.

Checkout setups are qualitative by nature. For years, Tembi has monitored how delivery providers are presented in checkout across large numbers of webshops.

With the Checkout score, this insight is now summarised per webshop, making it easy for carriers to identify where their service is not clearly surfaced and what is missing. The result is a simple, comparable overview of checkout visibility across all monitored webshops.

The Checkout score is built from observable elements in the checkout flow. Each webshop is assessed on whether key delivery information is explicitly presented to the shopper.

By default, the score covers three core parameters:

Each webshop receives a simple score (for example 1/3 or 2/3) along with a qualitative label (low, medium, high), making it easy to interpret at a glance.

The aim is not to define a perfect checkout, but to enable consistent comparison across clients, markets, and competitors.

The Checkout score is designed to support commercial and strategic teams by making checkout presentation visible, comparable, and trackable.

Key Account Management

Leadership

Checkout setups change frequently. Delivery options are added, renamed, re-sorted, or removed.

What previously required manual review across individual webshops can now be monitored systematically and at scale.

The Checkout score is calculated continuously and shown alongside historical data, allowing teams to:

This turns checkout from a static snapshot into an operational signal.

Not all last-mile providers care about the same things.

The Checkout score is configurable, allowing teams to decide which elements should be included based on their commercial focus. In addition to the default parameters, optional elements such as environment-friendly delivery can be enabled where sustainability positioning or green sorting plays a commercial role.

When additional parameters are enabled, the score adapts automatically – for example moving from a 3-point to a 4-point model.

As checkout decisions increasingly become automated, delivery information needs to be machine-readable as well as understandable to humans.

If a delivery option is present but poorly defined – missing a named provider, a clear method, or delivery timing – it becomes harder for both consumers and agents to select it.

The Checkout score makes delivery presentation explicit, structured, and measurable across all monitored webshops.

And once it is measurable, it becomes something teams can actively improve – rather than guess at.

Spain counts 89,038 active online retailers, with clothes & shoes leading the category mix, an estimated +1,2bn parcels/year, and average delivery prices at €4,9 (home) vs €4,4 (OOH) for lightweight items. Our new Spain report maps the market structure, checkout dynamics, delivery methods, and how the main carriers compete for visibility - including the often-overlooked impact of white-label checkouts.

If you’re working in last-mile delivery and want a competitive view of Spain, download the full report here.

This report focuses on nine of the largest delivery providers in Spain: Correos / Correos Express, MRW, GLS, SEUR/DPD/Tipsa, DHL, NACEX, FedEx/TNT, CTT, and InPost/Mondial Relay. End-to-end retail & logistics operators (e.g., Amazon) and smaller/specialised operators (refrigerated, oversized, etc.) are intentionally excluded to keep the comparison clean and actionable.

All figures are based on Tembi’s continuous monitoring and analysis of Spanish online retailers and checkout setups, with consistent classification to support like-for-like analysis across markets. Use it to maintain competitive advantage, capture share in attractive segments, and understand market dynamics with clarity.

Quick takeaways

Spain is home to nearly 90,000 active online retailers, with a long tail that still produces meaningful parcel demand - and a smaller set of large/very large retailers that set service expectations (speed, returns, OOH availability, and delivery choice). Category-wise, Spain’s retailer base is led by clothes and shoes (~12,19%), followed by health & medicine (~7,04%) and beauty & personal care (~6,3%).

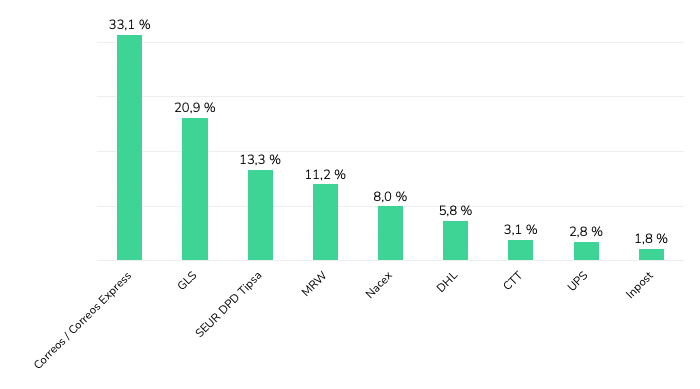

In Spain, share of presence (where a provider appears as an option in checkout) is heavily led by Correos / Correos Express, which shows up across ~41% of branded checkouts in our dataset, far ahead of the next tier (MRW, GLS, SEUR/DPD/Tipsa).

But presence is only half the story. In checkout, position matters.

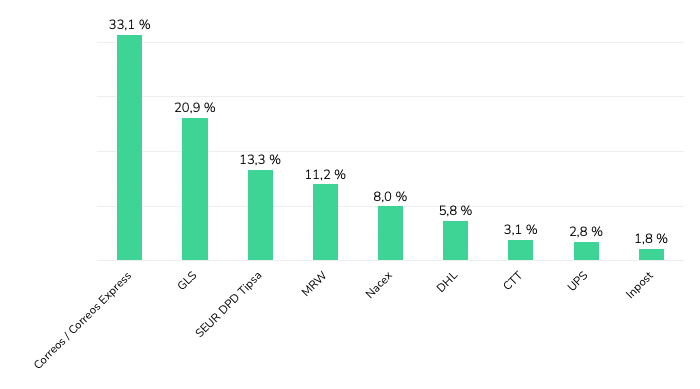

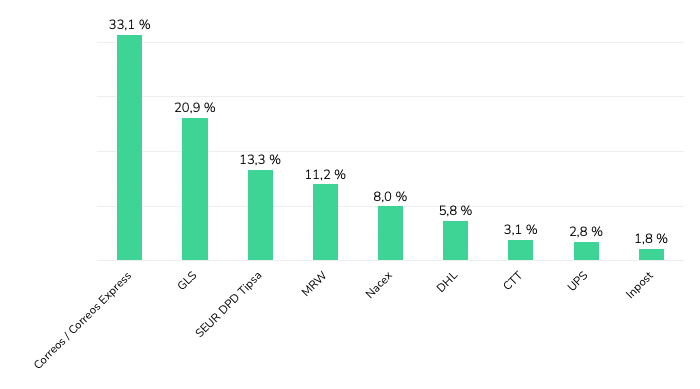

Across Spanish webshops where delivery provider brands are visible, Correos / Correos Express holds the first position most frequently (33,1%), followed by GLS (20,9%) and SEUR / DPD / Tipsa (13,3%). MRW (11,2%) and NACEX (8,0%) follow, with DHL (5,8%) and smaller shares for others.

If you read our Italy last-mile delivery analysis, you’ll recognise the same core idea: the checkout is the battlefield. The winners aren’t only those with the biggest networks - they’re the providers most consistently prioritised where consumers actually make the choice - why checkout position and visibility are a key differentiators in revenue and brand building.

Here is the uncomfortable truth for last-mile brands: a large share of Spanish retailers don’t show carrier names at all - they show only delivery methods and prices.

This matters because it means “market share” can look very different depending on whether you measure parcel volumes, merchant relationships, or brand visibility to consumers. For carriers, improving brand exposure inside white-label environments is one of the largest untapped levers in Spain - because it’s not a network problem, it’s a checkout/integration problem.

Across the market, home delivery is still the default, and the regulator view aligns with what we see in retailer setups: CNMC reports that in 2024 the usual delivery place was home (68,9%), with PUDO/convenience points (13,6%) and lockers (3,8%).

When we look at delivery methods displayed across retailers (excluding white-label checkouts), the same story holds: OOH is present, but underbuilt - especially compared to where Spain could go given consumer density and the cost-to-serve logic that OOH enables.

And pricing reinforces the direction of travel: for lightweight items, average delivery prices are roughly €4,9 (home) vs €4,3–€4,5 (OOH) depending on parcel shop vs locker. Spain is also cheaper than Italy across all options, which changes the “room” carriers have to subsidise adoption - but not the underlying incentive to densify OOH.

While retailers set the price shown in checkout, these figures consistently reflect provider positioning.

Not all “presence” is equal. The value of a provider’s retailer base depends on who those retailers are.

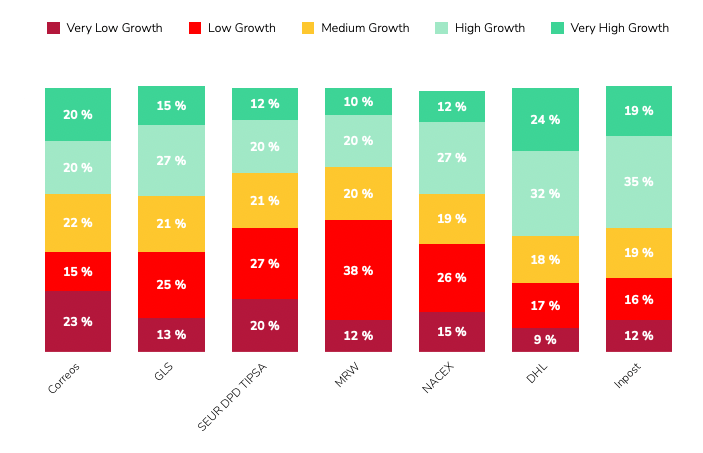

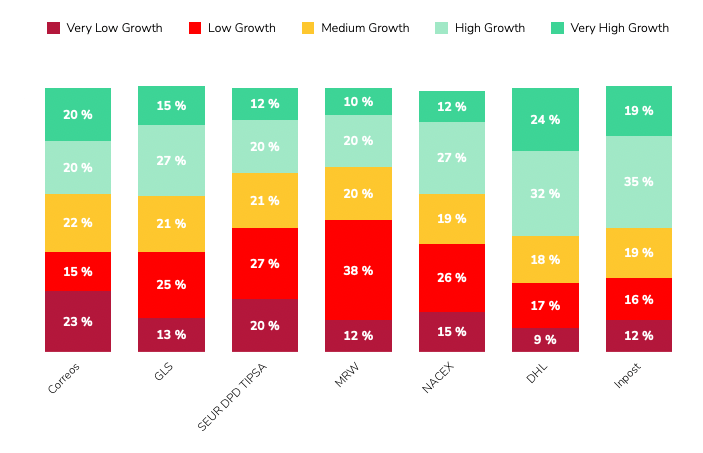

Using Tembi’s size scoring (0–100), we can see clear portfolio skews:

Category exposure shows the same idea from a different angle: providers aren’t just “generalists” - each ends up with a distinct category footprint (e.g., stronger concentration in health & medicine, fashion, electronics, etc.)

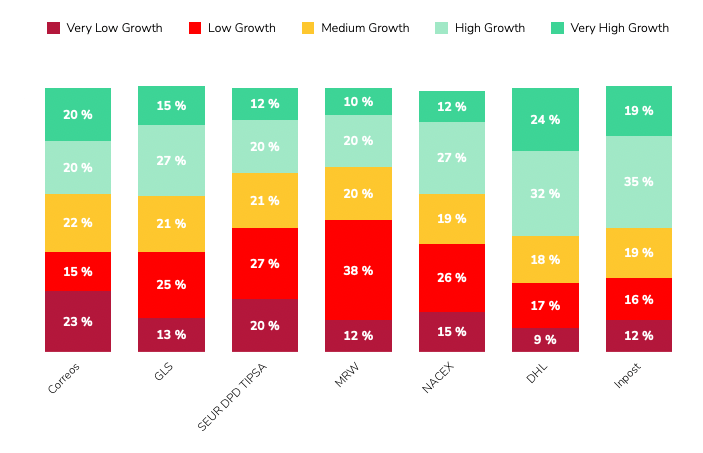

Finally, our Growth Indicator model adds a forward-looking layer: DHL and InPost have the strongest growth-weighted portfolios, with 56% and 54% of their clients forecast to be in high or very high growth bands. Correos shows a more balanced mix across growth bands.

If you want the practical “so what” for Spain, three things stand out:

Spain’s last-mile market is large, competitive, and still structurally under-optimised in checkout. Correos dominates branded presence and first-position frequency, white-label checkouts hide a big part of the market, and OOH remains a clear runway - with meaningful differences in portfolio quality and growth potential across providers.

Download the full Spain report, or schedule a Tembi demo to see your competitive landscape updated continuously across markets - including comparisons to our Italy analysis

Italy counts 94,724 online retailers, with clothing, groceries and beauty leading the mix, average home delivery cost at €6.5 and OOH at €5.8. With continued investment and InPost’s strong market entry, OOH delivery is expanding rapidly and reshaping the competitive landscape. This Italian last-mile delivery market analysis maps the structure, methods and provider portfolios behind the numbers.

Working in last-mile delivery and interested in another competitive market analysis beyond Italy? Let's connect. Download the full report here.

Italy remains one of Europe’s most active e-commerce markets by merchant count and parcel flow. To help last-mile executives benchmark strategy, this report profiles the market composition, delivery method availability and pricing, and the competitive landscape across six core providers: GLS, Poste Italiane, DPD BRT, DHL, InPost, and FedEx (TNT). You’ll see where demand concentrates by category, how pricing positions each method, and how provider client portfolios skew by retailer size and expected growth.

All figures are derived from Tembi’s continuous monitoring and analysis of Italian online retailers and checkout setups, with consistent taxonomy and normalisation to support like-for-like comparisons. Use it to maintain competitive advantage, capture share in attractive segments, and understand market dynamics with clarity.

Quick takeaways

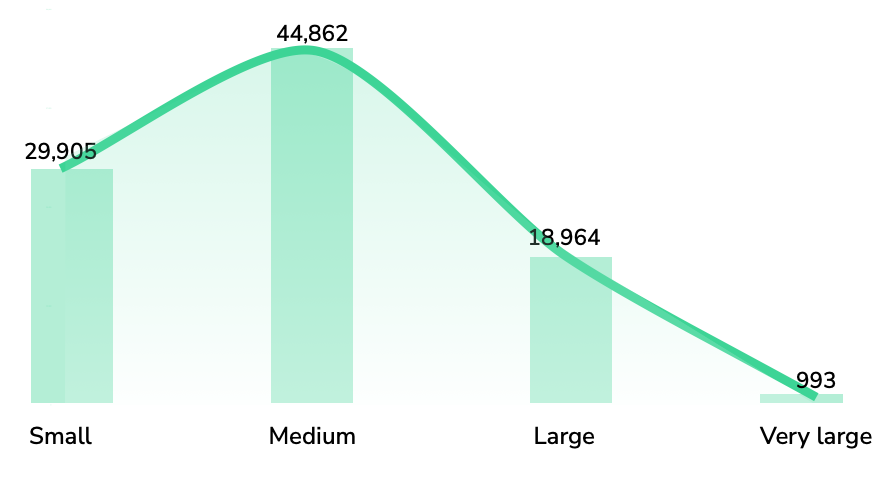

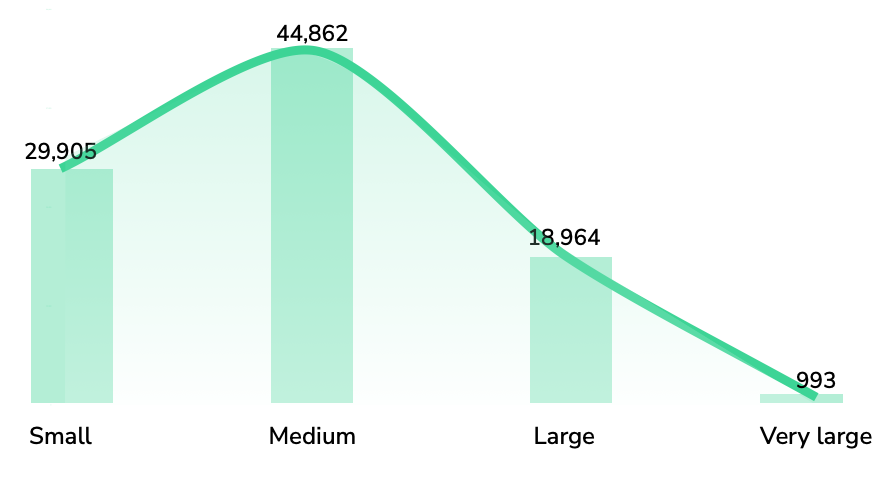

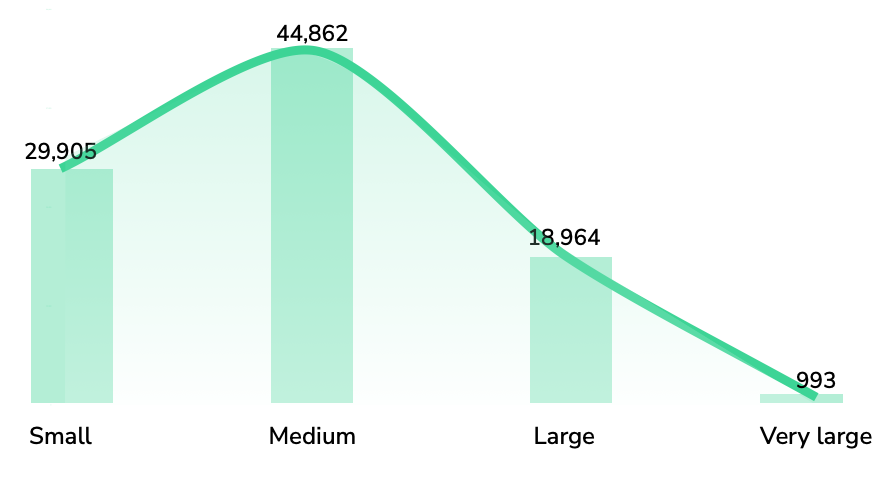

Italy’s 94,724-strong retailer base skews to clothes & shoes (≈12.1%), then food & groceries (≈6.7%), and beauty (≈5.4%). The size pyramid shows most merchants are medium, fewer large, and about 1% very large, indicating a wide long-tail with concentrated head accounts that influence parcel mix and service expectations. The latest available data from 2020 suggest that around 830 million parcels are shipped domestically each year. Given the latest e-commerce growth estimation of an average annual growth rate of 4.5%, parcel volumes could now be approaching one billion shipments.

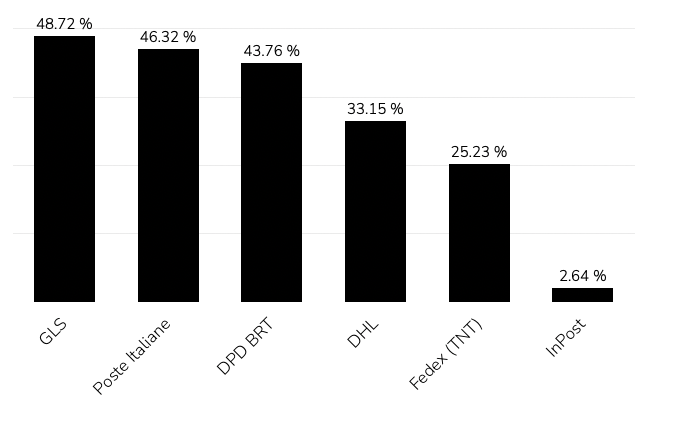

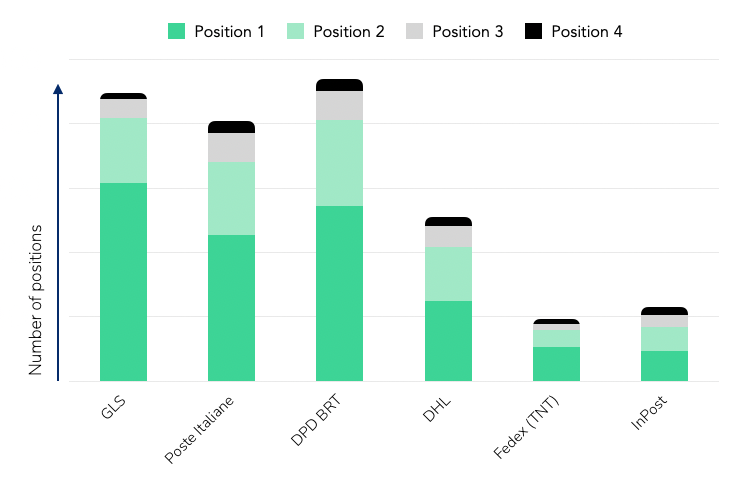

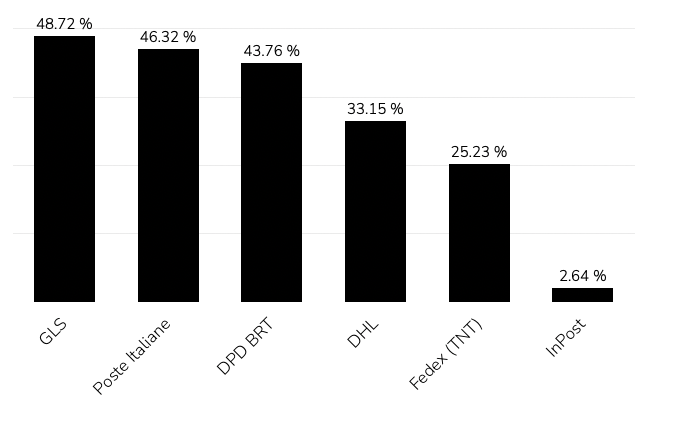

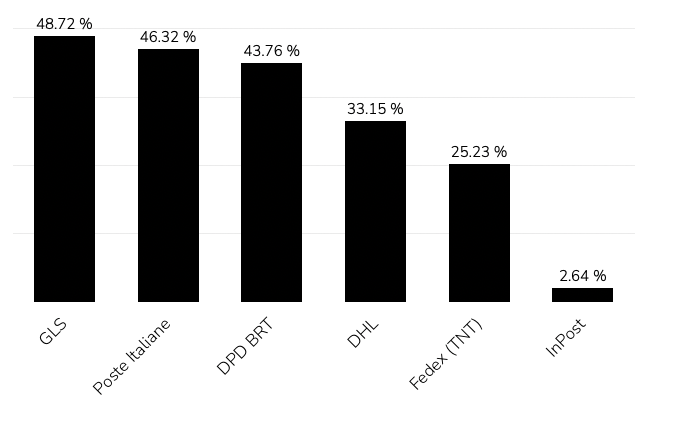

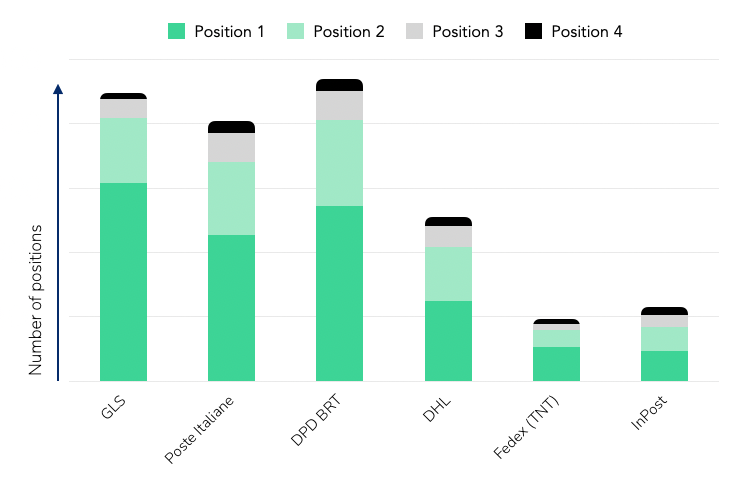

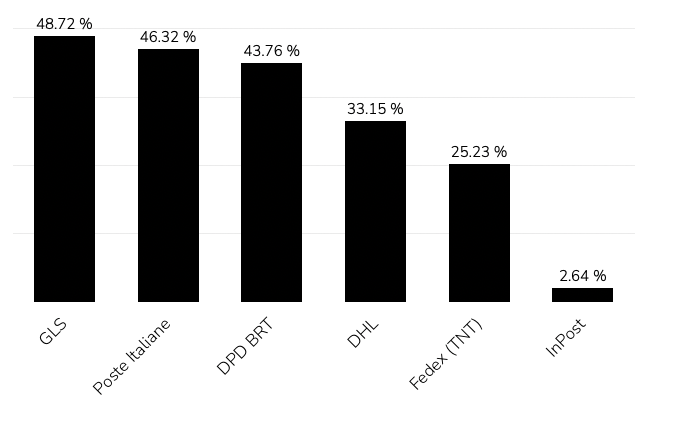

GLS and Poste Italiane hold the broadest presence across Italian webshops - GLS appears in 48.7% of retailer checkouts and Poste Italiane in 46.3%. DPD BRT, DHL, InPost, and FedEx (TNT) follow, forming the rest of the competitive landscape.

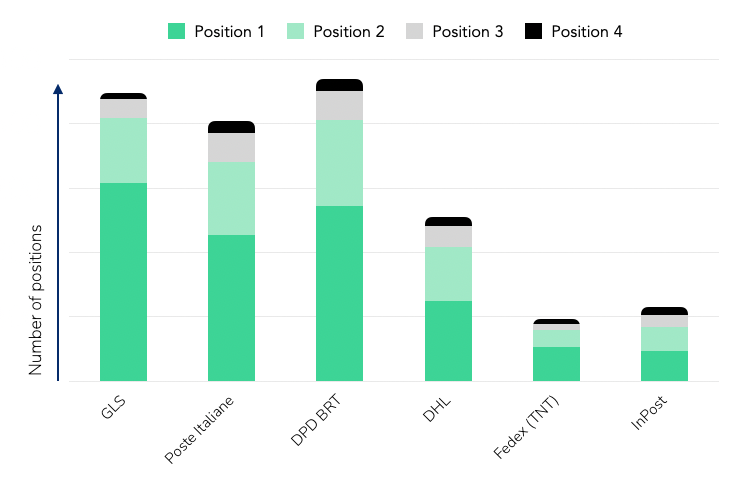

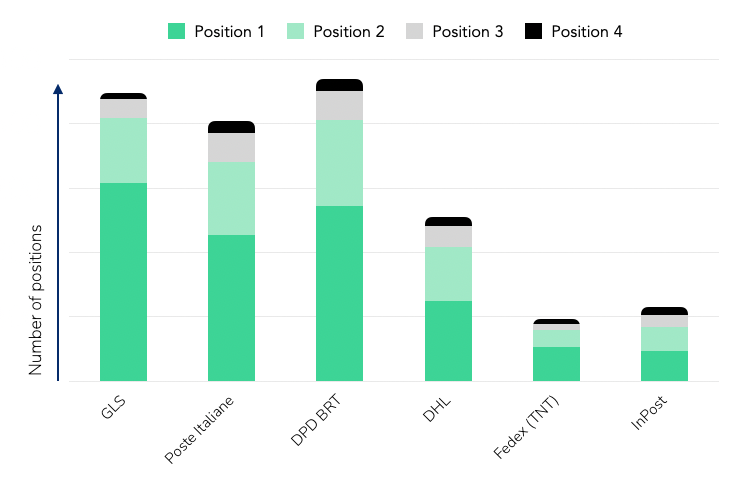

When looking at the first delivery option offered to shoppers, GLS leads with roughly 30%, followed by DPD BRT (26%) and Poste Italiane (22%).This ordering pattern reflects how retailers prioritise providers based on network reach, reliability, and negotiated terms rather than pure visibility.

In short:

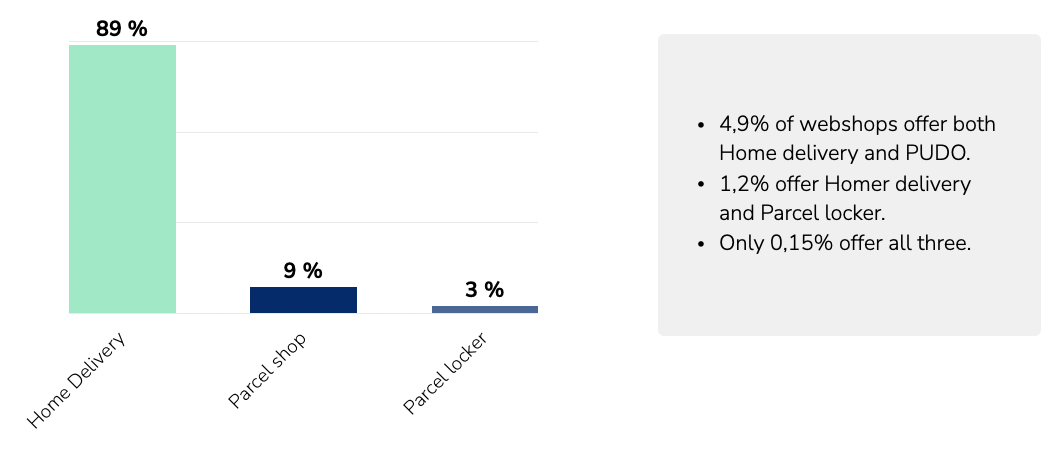

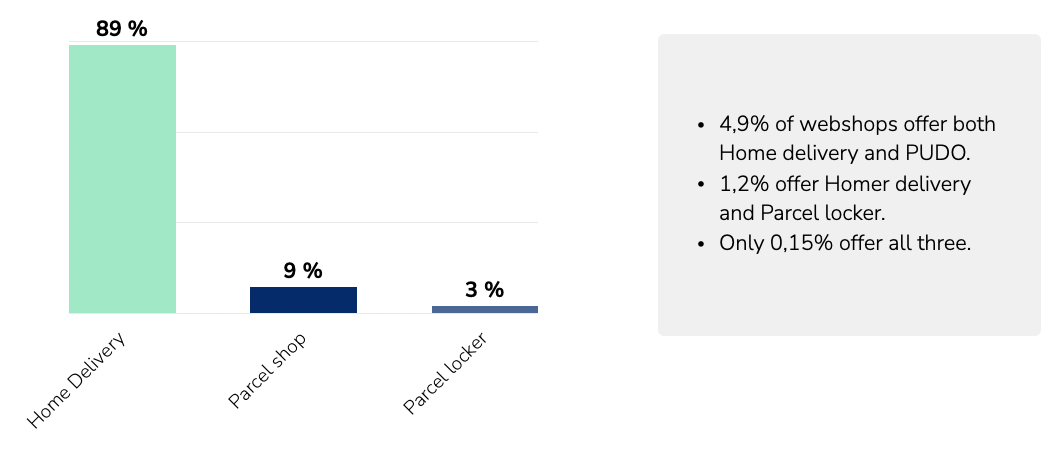

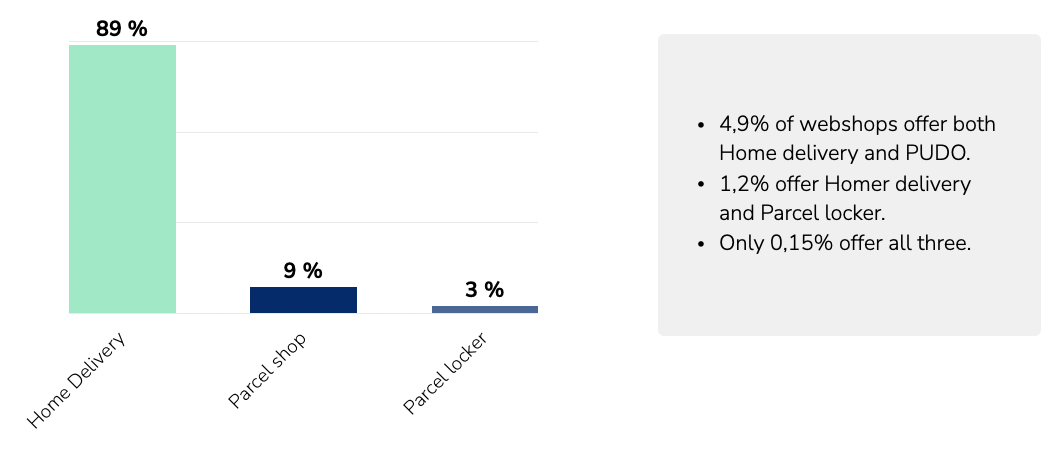

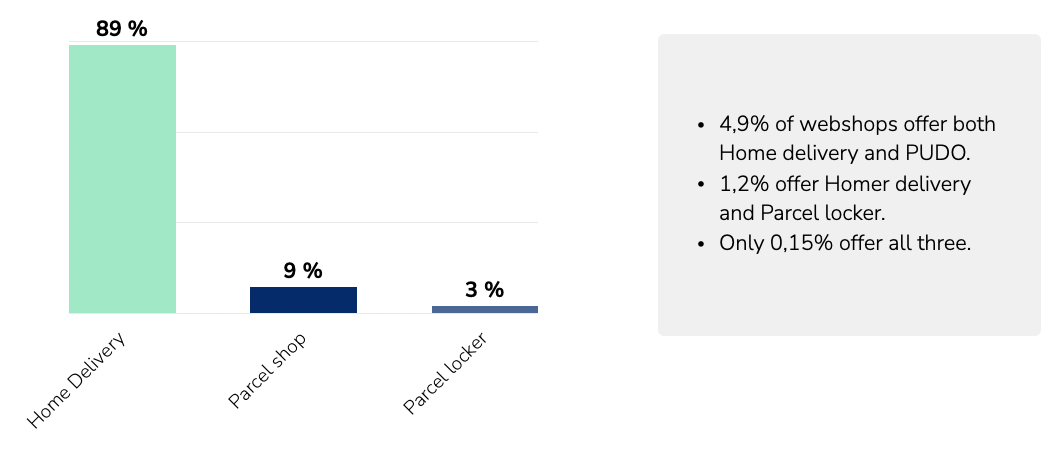

Across Italian retailers, home delivery remains dominant, offered by roughly 89% of webshops. Parcel shops (≈9%) and parcel lockers (≈3%) are still at an early stage of rollout, but both formats are expanding as networks and integrations mature.

The limited share of OOH options reflects the market’s current infrastructure capacity rather than consumer demand alone. With continued investment from providers such as InPost, Poste Italiane, and DPD BRT, OOH coverage is expected to increase steadily over the next few years, giving retailers broader flexibility in how they structure delivery choices and costs.

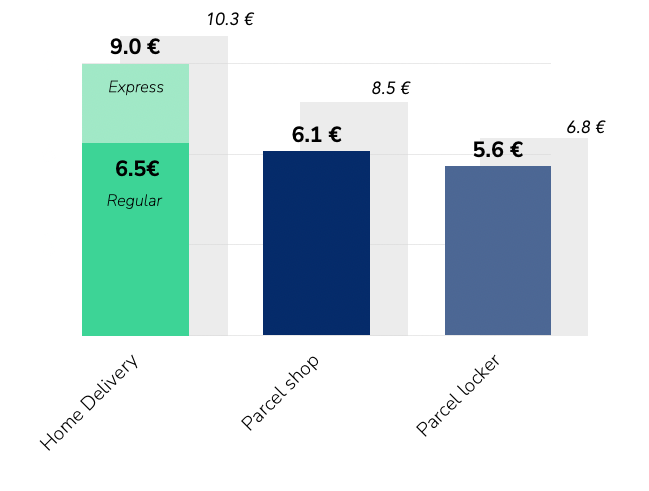

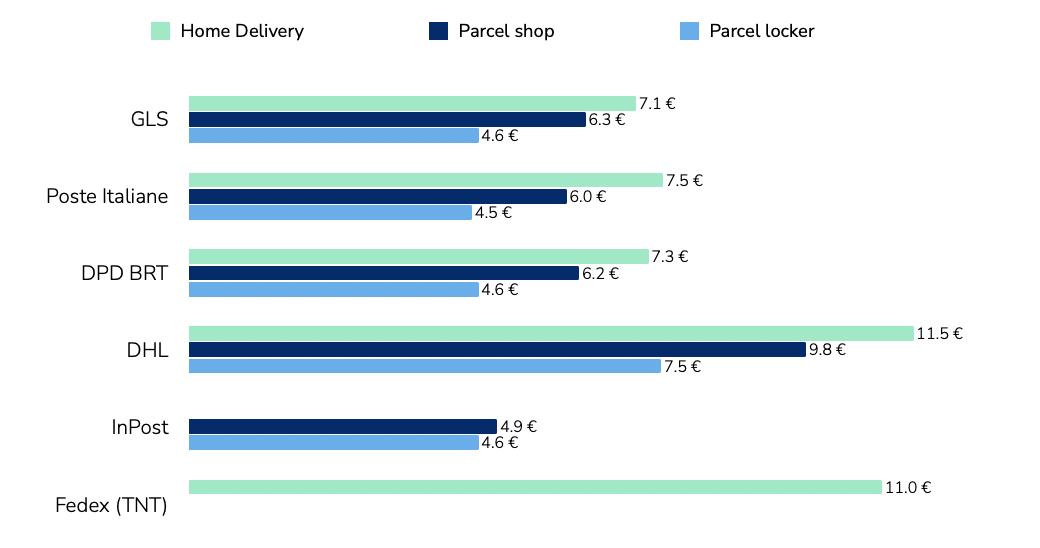

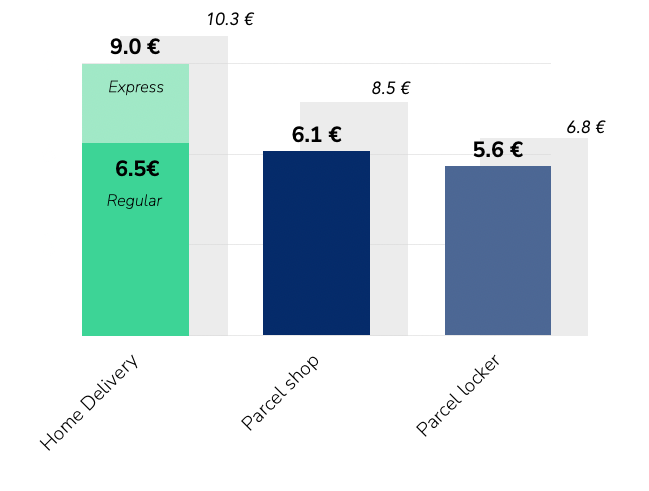

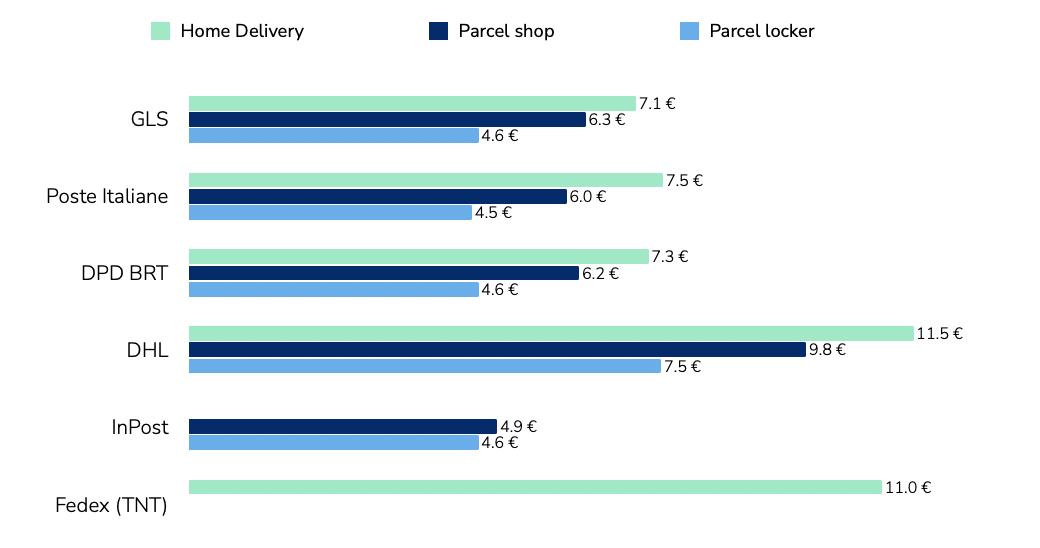

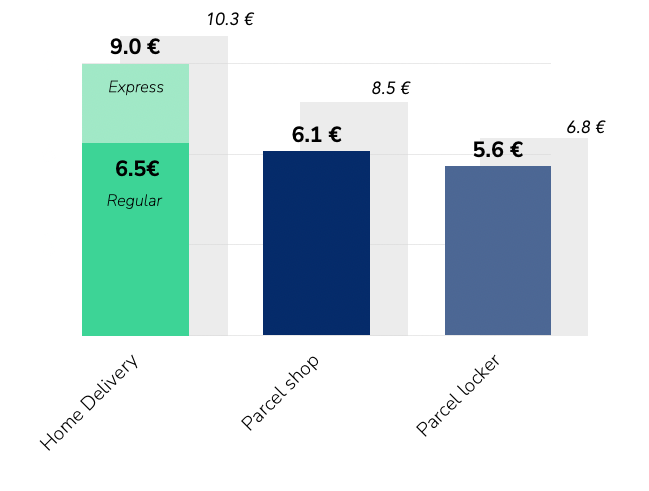

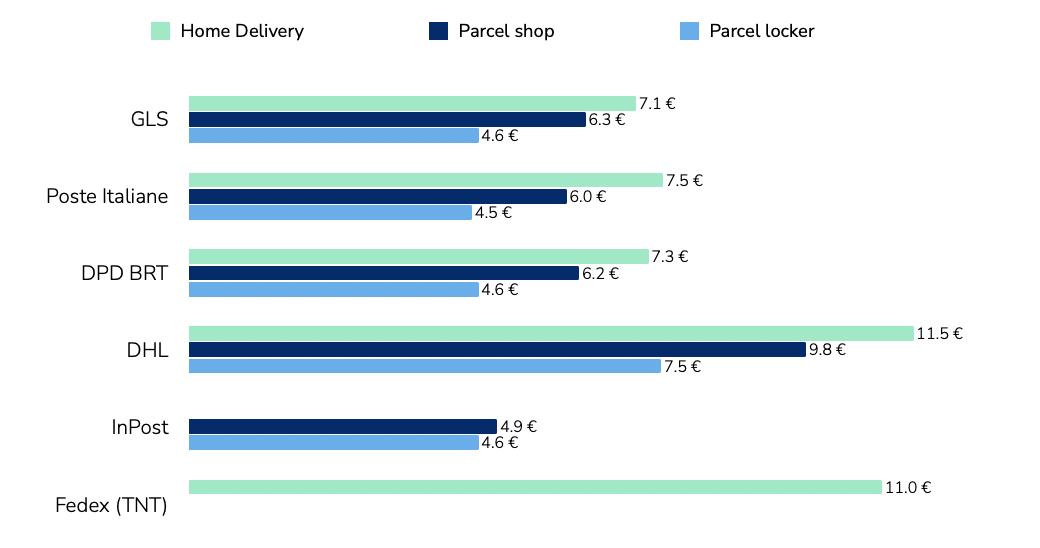

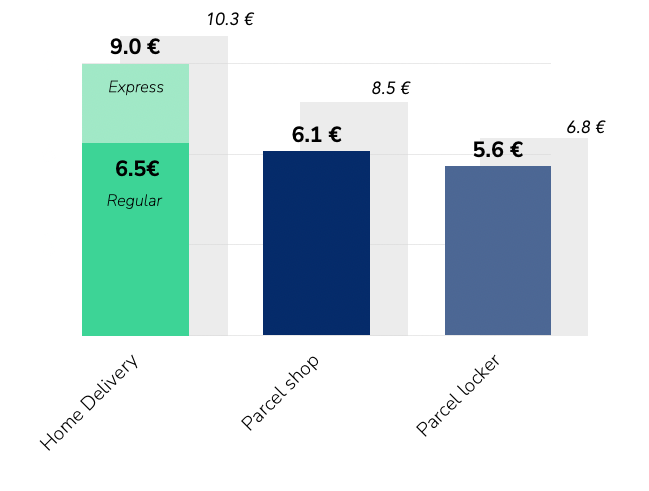

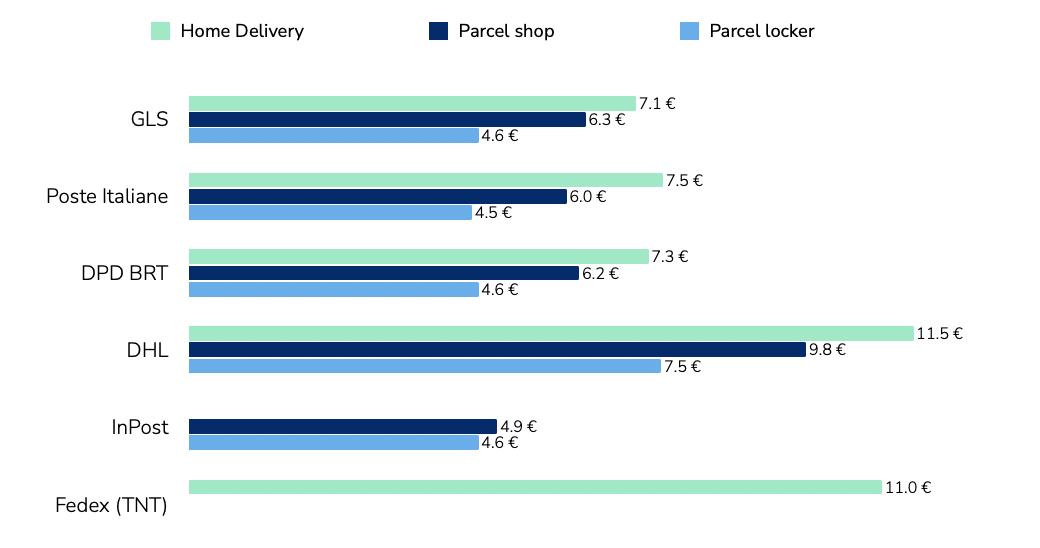

Pricing across delivery methods follows a clear hierarchy. Home delivery is the most expensive, with DHL and FedEx (TNT) positioned at the higher end in line with their express and international focus.GLS, Poste Italiane, and DPD BRT sit around the market average, reflecting large-scale domestic coverage and standardised pricing structures. InPost maintains the lowest price levels across OOH deliveries, consistent with its parcel-locker model and high network density.

The pricing gap between home and OOH - €6.5 vs €5.8 on average - highlights the economic rationale for providers to keep expanding out-of-home capacity, and in line with most other markets. As networks grow denser, these price differences will continue to influence retailer delivery mix.

Tembi’s analysis segments retailer clients by size and growth outlook, showing how each provider’s portfolio is positioned across the Italian market.

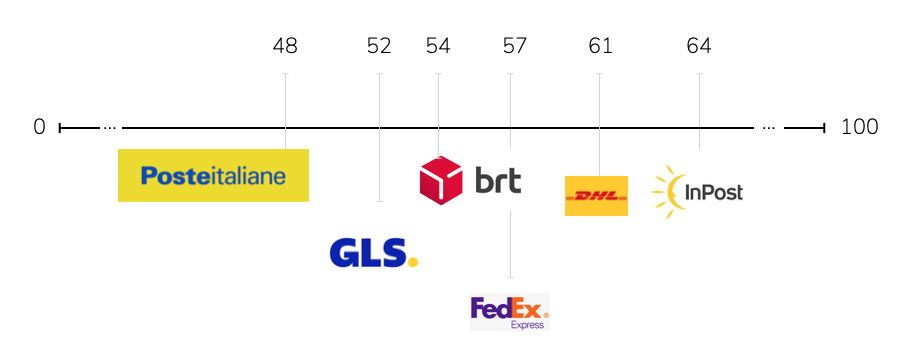

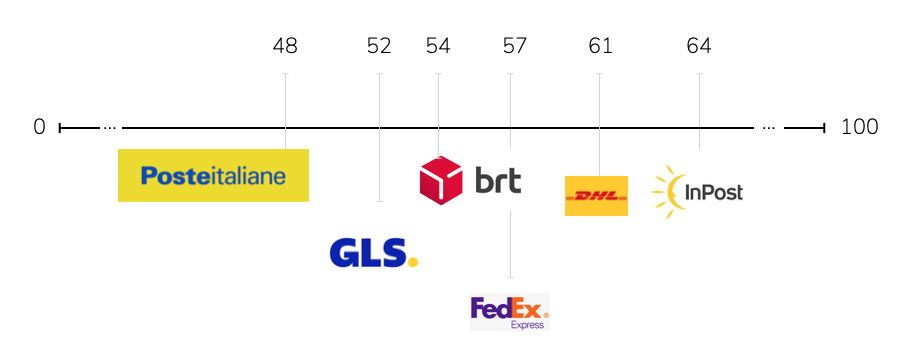

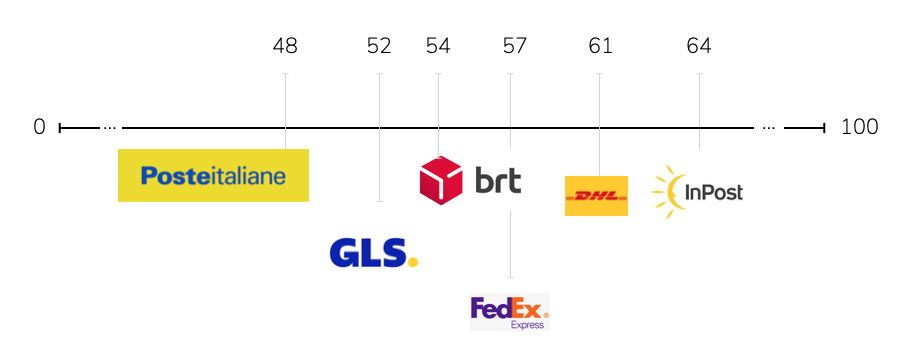

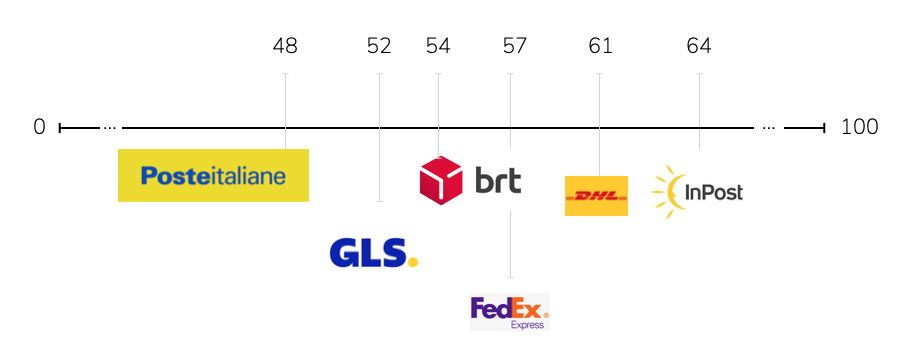

This chart summarises the average retailer size of each provider’s client base on Tembi’s 0–100 scale, where higher scores represent larger and more established webshops.

The stacked bars show how each delivery provider’s clients are distributed by retailer size:

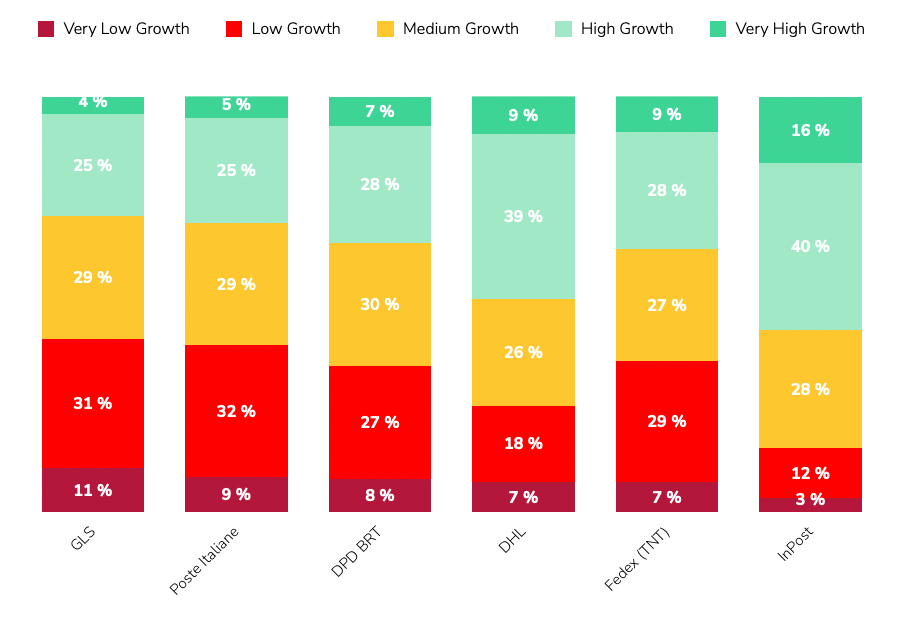

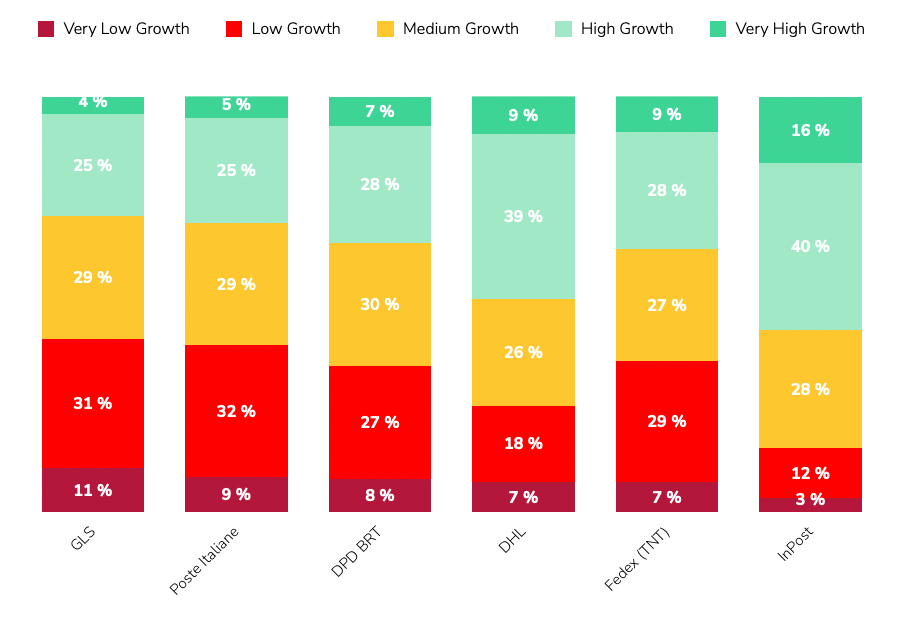

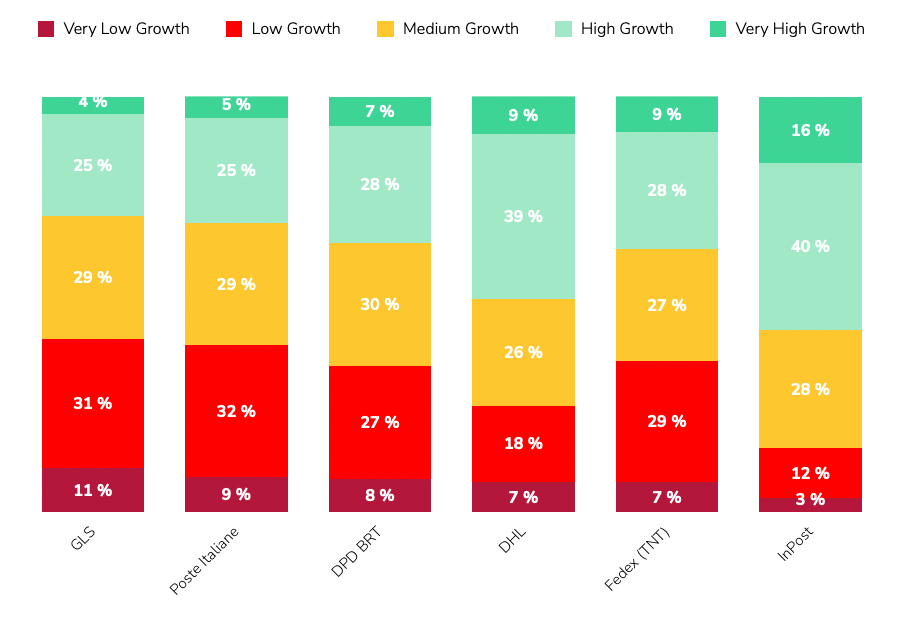

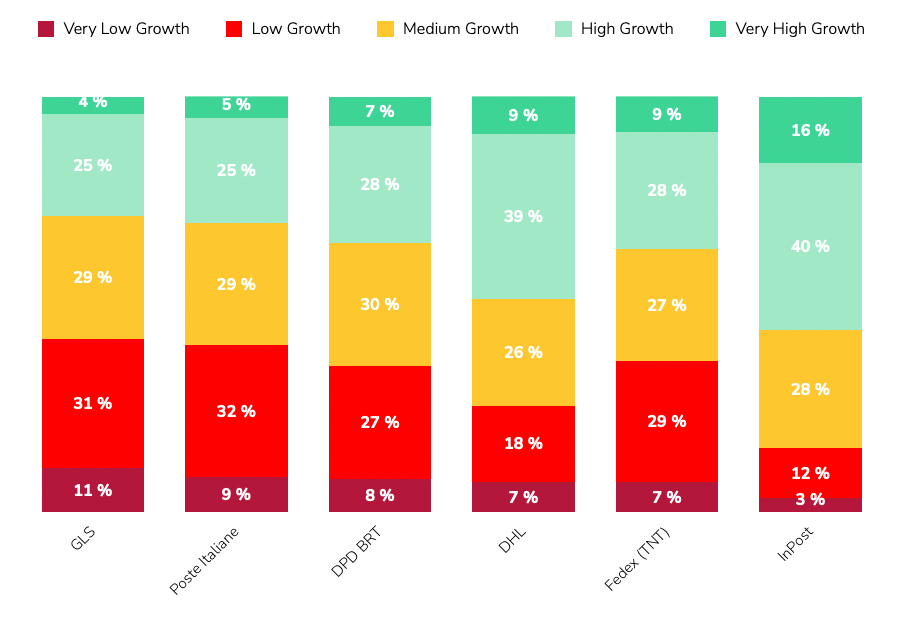

Using Tembi’s forward-looking Growth Indicator - a composite of product portfolio development, traffic momentum, financial proxies, and export activity - InPost has the highest share of high- and very-high-growth retailers, reflecting its alignment with fast-scaling digital merchants. DHL also skews towards higher-growth segments, supported by its express and cross-border strengths. Meanwhile, GLS, Poste Italiane, and DPD BRT hold proportionally larger bases of mature retailers, providing stability and recurring parcel volume.

Locker and parcel shop networks are entering a phase of rapid expansion across Italy.InPost leads with more than 3,000 lockers installed at the start of 2025. DHL and Poste Italiane jointly reported around 500 lockers by mid-2025, alongside an ambitious plan to reach 10,000 units in the coming years. DPD BRT, through its Fermopoint network, aims for up to 4,000 lockers within five years, while GLS initiated its own rollout during 2025.

This coordinated investment places Italy on a clear multi-year OOH growth trajectory, reshaping how carriers balance cost, capacity, and customer reach. The build-out is not just a convenience upgrade; it’s a structural shift in network economics - each new locker or parcel shop reduces last-mile cost per parcel and expands delivery capacity in urban areas.

Why it matters

Rising locker and parcel shop density directly influences:

As the network matures, OOH will become a central component of Italy’s last-mile infrastructure, shaping both consumer choice and carrier efficiency.

Tembi’s analysis highlights three practical dimensions that matter for market strategy and portfolio alignment.

1. Segment by retailer size and category

Italy’s retailer landscape is dominated by small and medium merchants, but larger and premium-category retailers - such as fashion, beauty, and consumer electronics - set higher expectations for service speed, reliability, and returns. Delivery providers should align SLAs, OOH coverage, and returns management to match those standards while maintaining efficient access to the long tail.

2. Model the price–mix effect

With home delivery averaging €6.5 and OOH €5.8, even a modest shift in checkout mix can materially improve cost-to-serve for both carriers and retailers. Tracking these dynamics by category and region helps identify where OOH incentives or dynamic checkout sequencing can achieve measurable margin impact.

3. Track portfolio momentum

Provider client portfolios differ in growth exposure. InPost and DHL are more concentrated among high-growth retailers, while GLS, Poste Italiane, and DPD BRT anchor the market’s stable core. Monitoring these shifts over time helps providers balance predictable SMB volume with faster-growing digital retailers, ensuring coverage across both maturity extremes.

Italy’s last-mile market is broad, price-competitive, and evolving. Method economics continue to favour OOH expansion as networks densify; provider portfolios show divergent exposures across retailer size and growth; and the locker build-out marks a long-term structural transformation rather than a short-term initiative.

This Italian last-mile delivery market analysis outlines the market map and comparative signals needed to inform planning, benchmarking, and partnership strategies across the sector.

Download the full Italian market report or schedule a Tembi demo to see your competitive view updated continuously.

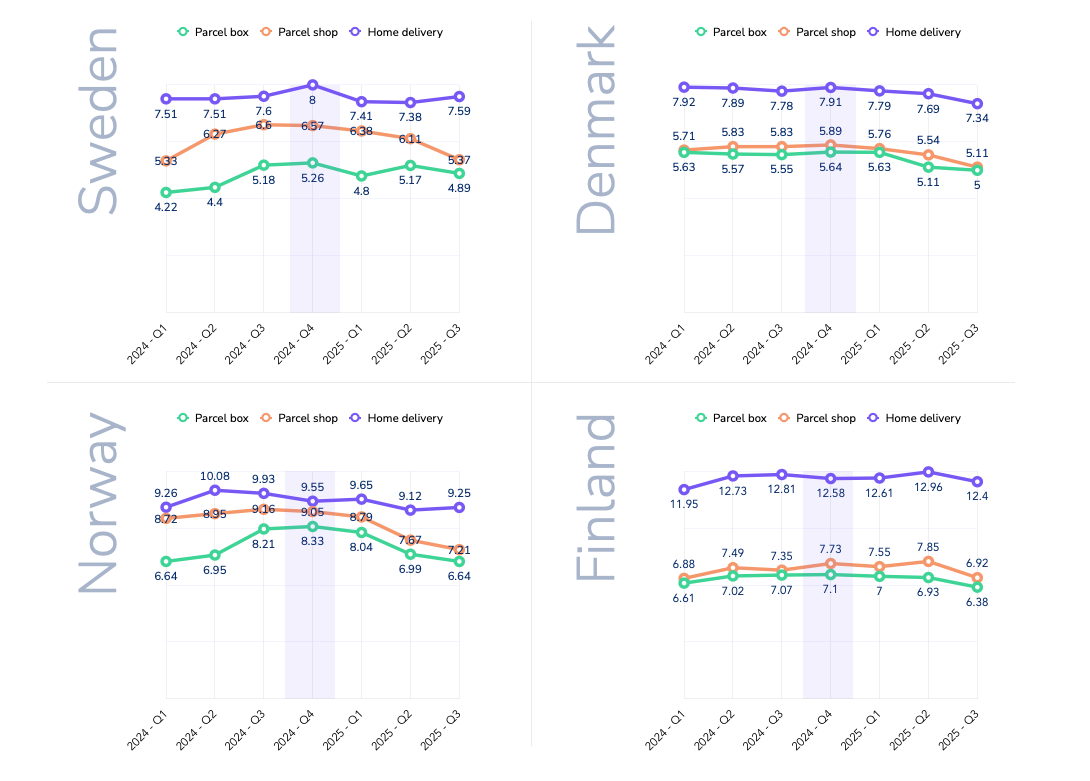

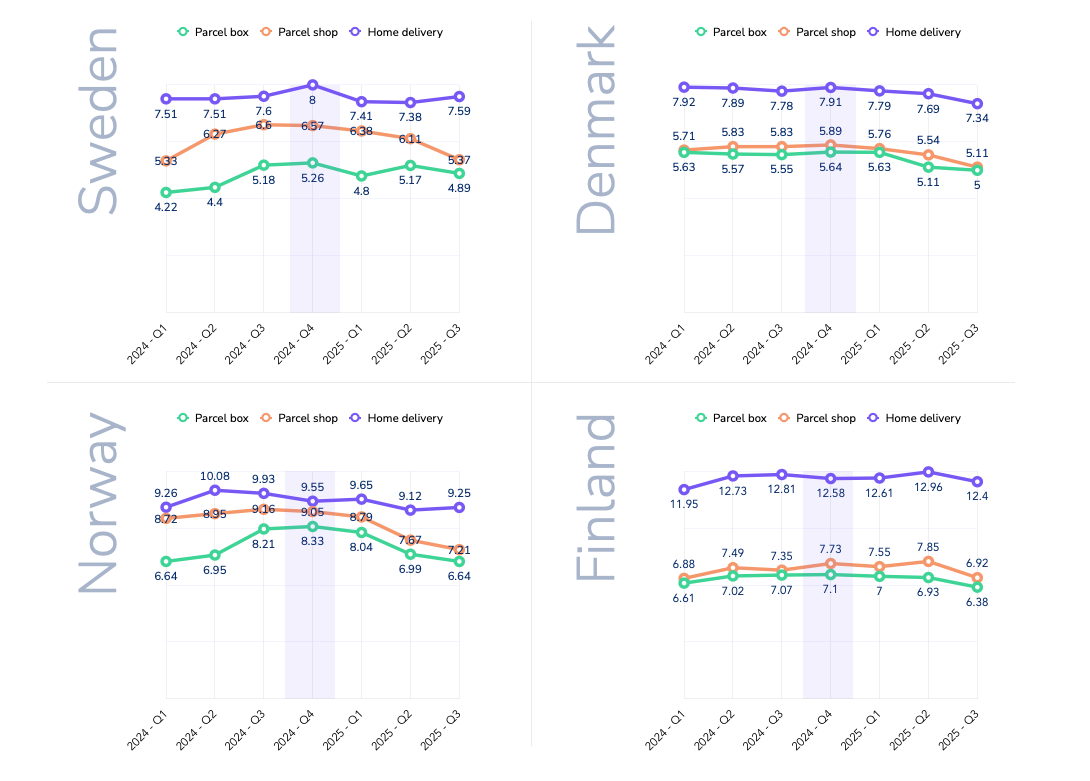

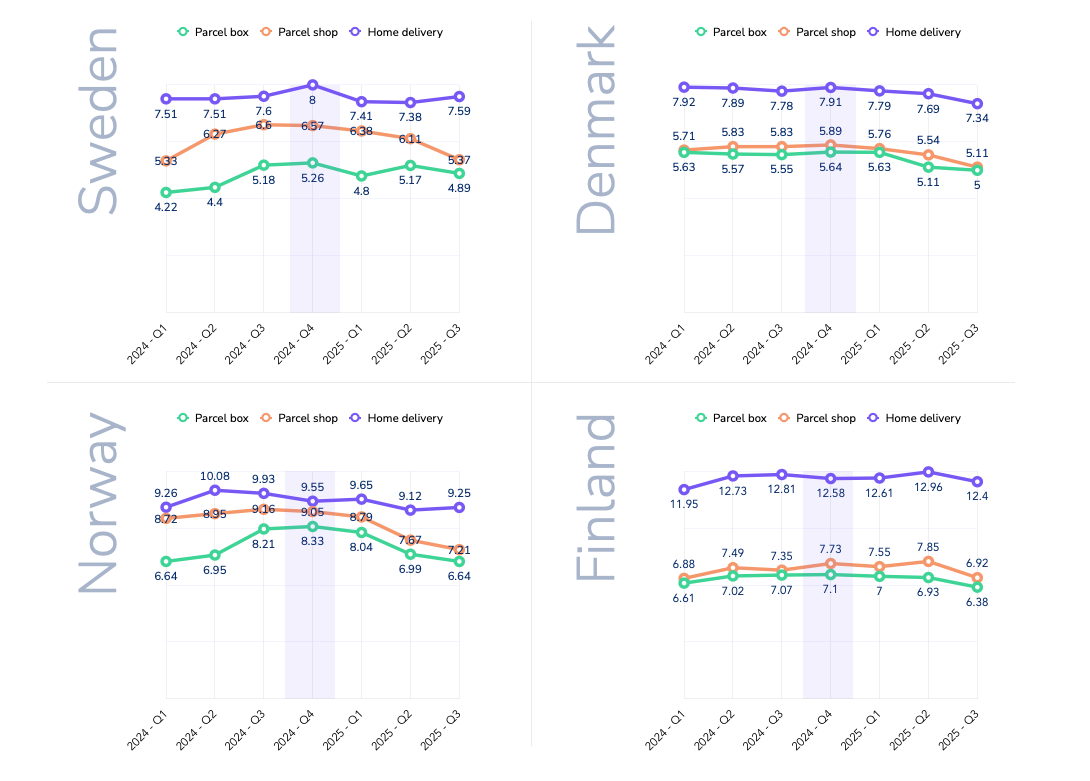

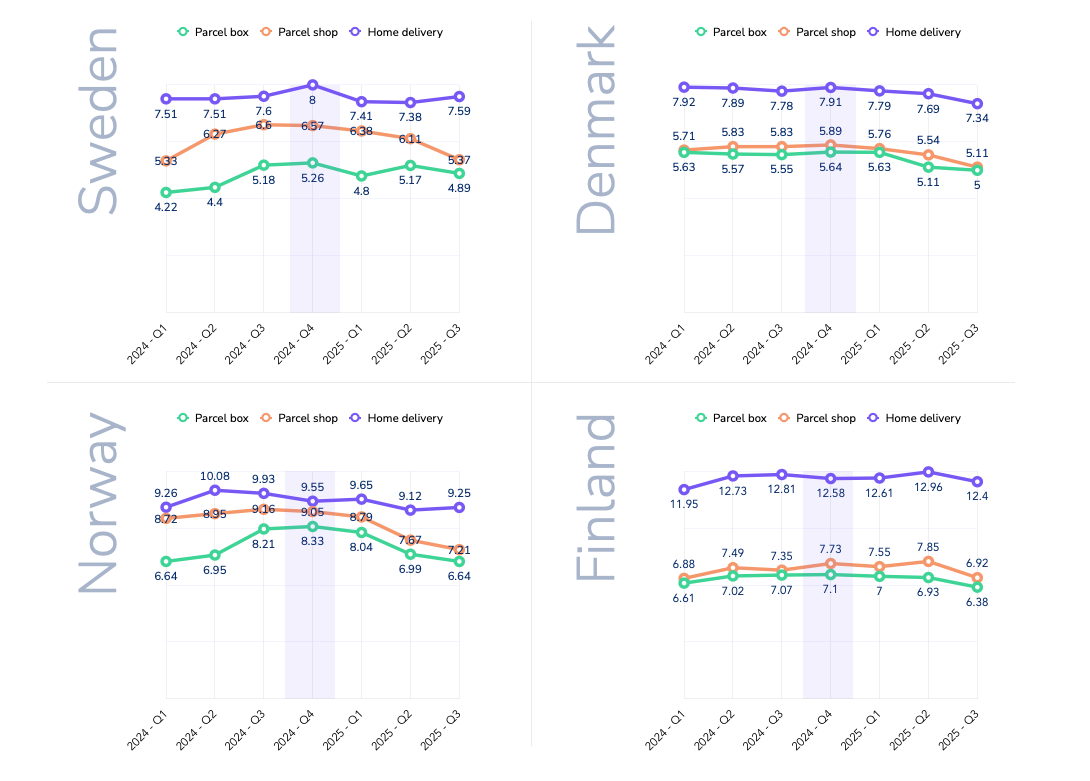

Delivery fees across the Nordics have followed clear seasonal patterns and strategic adjustments over the past two years. Drawing on data from over100,000 webshops in Sweden, Denmark, Finland, and Norway between Q1 2024 and Q32025, we track how average consumer delivery prices (in EUR) have shifted.

This analysis zooms in on the Q4 holiday peak, highlights country-specific behaviours, and compares delivery methods in urban areas - parcel lockers, pickup points, and home delivery. The aim is to show how webshops shape their pricing strategies and how these evolve through the year.

Seasonality is a defining feature of delivery pricing in the Nordics. Q4, the peak holiday quarter, typically brings stable or higher fees rather than discounts. In late 2024, Black Friday and Christmas did not lead to cheaper delivery - instead, many webshops kept prices firm or lifted them slightly.

· Sweden: average home delivery rose from €7.60 in Q3 2024 to €8.00 in Q4, the annual peak.

· Denmark: small increases, such as parcel shop delivery at €5.89 in Q4 versus €5.83 inQ3.

· Finland: parcel shop fees jumped by around 5% in Q4 2024.

· Norway: parcel box delivery peaked during the holiday quarter.

The pattern suggests that in high-demand Q4, retailers prioritise covering fulfilment costs over cutting fees - even when running heavy sales campaigns.

This shifts in Q1, when prices correct downward. After the holiday rush, many webshops reduced or normalised fees:

This Q1 softness reflects the post-holiday slowdown in demand and renewed competition to attract consumers during a quieter season.

Q4 2024 stands out as a high point for delivery fees in several markets, corroborating that peak season surcharges and fewer free-shipping promos were in effect. In fact, during Black Week (Black Friday 2024), retailers across Noridcs reduced the prevalence of free shipping by 4% compared to 2023, opting instead to set spend thresholds or promote premium paid options (source: ingrid.com). In other words, fewer orders enjoyed “free delivery” in Q4 2024, as merchants nudged customers toward paid faster delivery or order bundling.This strategic move helped protect margins during the holiday boom – and consumers generally went along, paying for delivery when the value (speed, convenience) was clear (source: ingrid.com). The seasonal insight here is that peak demand doesn’t equal cheaper shipping; if anything, many webshops use the period to upsell premium delivery or maintain prices, rather than offer blanket free shipping.

Moving through 2025, the Q2 and Q3 2025 data show an interesting reset. By summer 2025, average delivery charges in many categories fell back to or below their levels from the previous holiday season. This sets the stage for how Q4 2025 might play out – which we’ll discuss in a moment.

Each Nordic market shows distinct pricing dynamics, shaped by competition, consumer behaviour, and delivery costs.

Swedish webshops consistently post the lowest delivery fees in the region.In early 2024, prices were modest - around €4.20 for locker delivery and €7.50 for home delivery. These rose steadily through the year, with parcel box and parcel shop deliveries more than 20% higher by Q3/Q4. Home delivery peaked at €8.00 in Q42024, reflecting inflationary pressures and webshop/carriers passing higher rates on to consumers.

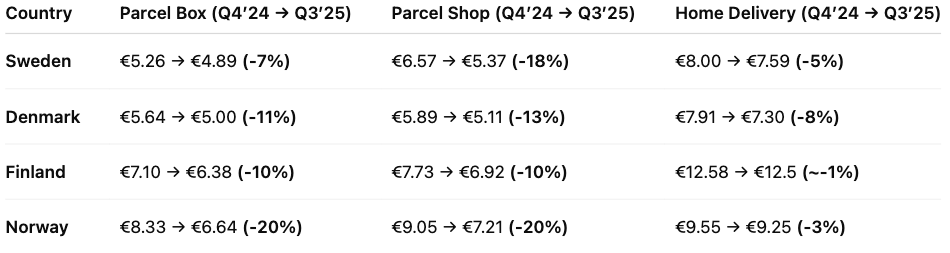

In 2025, the trend reversed. By Q3 2025, parcel shop delivery had dropped from €6.57 in Q4 2024 to €5.37 (an 18% decline),while home delivery eased back to €7.59. This points to intensifying competition, with Swedish retailers willing to cut delivery prices quickly to gain an edge.

Denmark’s delivery pricing remained stable through 2024, with parcel lockers and pickup points in the mid-€5 range and home delivery around €7.80–7.90. Even in Q4, increases were marginal- for example, parcel shop delivery at €5.89 in Q4 versus €5.83 in Q3.

The shift came in 2025. By Q3, parcel lockers averaged €5.00 and parcel shops €5.11 - 10–13% lower than the prior holiday season. Home delivery also dipped to €7.30 from €7.91 in Q4 2024. This gradual decline suggests Danish webshops began competing more actively on delivery price or carriers pressed the prices further down.

Finland remains the most expensive Nordic market for delivery - especially for home delivery. In 2024, Finnish shoppers paid €12–13 for home delivery, nearly double Sweden’s average. Out-of-home methods were also high at €7+. Prices climbed steadily through 2024, with parcel shops up 12% by Q4.

In 2025, home delivery crept even higher, peaking at €12.90 in Q2. But by Q3, parcel locker and shop fees had fallen sharply - down about 10% from Q2, back to early-2024 levels. Home delivery stabilised around€12.50.

Norway experienced the most pronounced swings. In 2024, home delivery peaked at €10.08 in Q2, while parcel lockers (€8.21) and parcel shops (€9.16) hit highs in Q3. Interestingly, Q4 home delivery was lower than earlier in the year at €9.55.

By 2025, Norwegian webshops had cut prices heavily, especially for out-of-home delivery. Parcel lockers fell from over €8in late 2024 to €6.64 by Q3 2025- a 20% year-on-year drop. Parcel shop delivery followed a similar pattern, down about €1.20 on average versus Q4 2024. Home delivery also eased slightly to €9.25 by Q3.

The widening price gap between home and pickup options suggests a deliberate push to shift volume to more cost-efficient methods. For carriers, Norway highlights how quickly competitive conditions can change - and the need to adjust pricing strategies in real time.

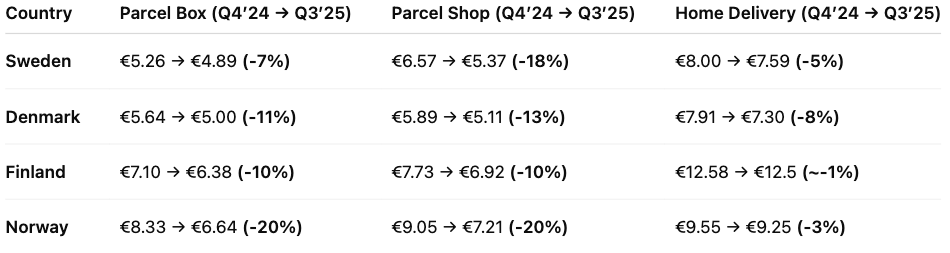

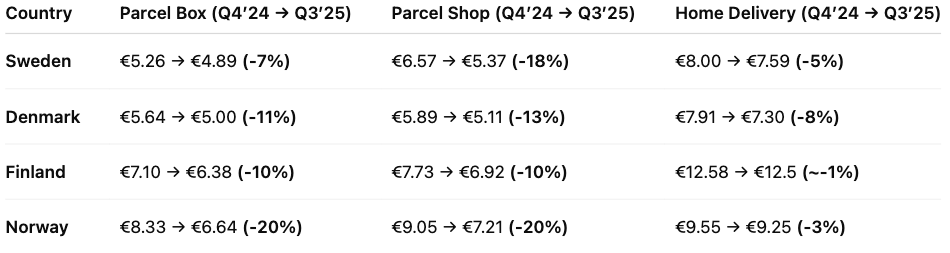

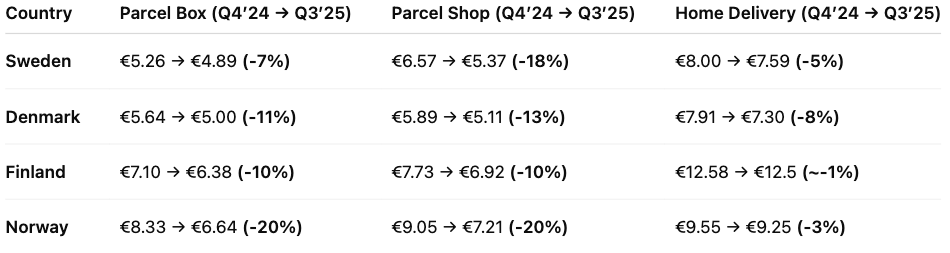

To summarize the country trends, Table 1 highlights how delivery fees in Q3 2025 compare to the last peak season (Q42024). Most markets saw notable declines in that period, especially for out-of-home deliveries:

Data clearly shows that out-of-home delivery is significantly cheaper for consumers in urban areas – a natural effect when carriers can deliver 5–10 times more parcels per driver compared with home delivery.

Parcel box (locker) delivery

· Cheapest option across all markets by 2025(~€5–6.5).

· Prices spiked in 2024 (e.g. Norway €6.6 → €8.3)but dropped back sharply in 2025.

· Volatility suggests retailers test price sensitivity, then reset as competition kicks in.

Parcel shop(pickup point) delivery

· Typically a few cents above lockers, but fell notably in 2025.

· Norway: from ~€9 in 2024 to €7.2 by Q3 2025.

· Pricing gap with home delivery widened, creating strong incentives for consumers to choose pickup.

Home delivery

· Premium service, consistently the most expensive.

· Held steady through 2024–25: ~€7.5 in SE/DK,~€9.3 in NO, ~€12.5 in FI.

· Only small price drops, with Sweden (-13% YoY)the exception.

· Discounts remain rare and tied to high order values.

Out-of-home delivery became cheaper in 2025, while home delivery kept its premium. This reflects a conscious decision: steer demand towards lockers and pickup points to cut last-mile costs and ease peak-season pressure. Black Week 2024 showed the effect in practice - locker usage rose by four percentage points and delivery times improved as shoppers embraced flexible collection (source: ingrid.com).

For logistics providers and retailers, aggressive pricing on out-of-home delivery seems to become a core lever: it nudges cost-conscious consumers, reduces operational strain, while keeping satisfaction high. But the gap has limits - home delivery still anchors convenience expectations and remains a profit lever. The real challenge is balance: keeping lockers and pickups highly attractive without eroding the value or accessibility of home delivery.

Collaboration between retailers and logistics providers is key here, ensuring service levels meet expectations as more customers choose out-of-home - seen clearly during Black Week, when lockers not only gained share but also delivered faster on average (source: ingrid.com).

To keep the forecast transparent, we applied a simple model: for each country × delivery method, we took the Q4-over-Q3 seasonal change from 2024 and applied that ratio to Q3 2025 levels. Where 2025 trended lower than 2024, we also include a conservative midpoint between Q3 2025 and that baseline.

· Parcel box(lockers): €5.6–6.0

· Parcel shop(pickup): €6.1–6.3

· Home delivery: €9.0–9.2

Seasonal lift from Q3 to Q4 looks modest. Home delivery remains the premium option, while lockers and parcel shops stay clearly cheaper.

· Sweden: home ~€8.0 (flat vs last year); parcel shop ~€5.3 and lockers ~€5.0 (well below last year).

· Denmark: home ~€7.4; parcel shop ~€5.2; lockers ~€5.1 (all lower than last year).

· Finland: home ~€12.5 (still high); parcel shop ~€7.3; lockers ~€6.4 (both down year-on-year).

· Norway: home ~€9.25 (slightly below last year); parcel shop ~€7.1; lockers ~€6.7 (~20%down year-on-year).

Nordic delivery prices have eased through 2025 after peaking in late 2024, especially for out-of-home options (parcel box and parcel shop). Applying last year’s Q4-over-Q3 seasonality to current Q3 levels points to only small Q4 uplifts: lockers and pickups remain the low-cost choices, while home delivery stays premium and broadly flat.

Country patterns matter. Sweden and Denmark have lower 2025 bases and limited room for Q4 increases. Finland remains structurally high - especially on home delivery - so stability is more likely than hikes. Norway has corrected sharply this year, with retailers continuing to nudge volume toward cheaper lockers and pickups.

The underlying pricing strategies are clear:

· Continued shift to out-of-home delivery. Lower pricing here is deliberate - directing volume away from costly home delivery and easing last-mile strain.

· Home delivery as a premium anchor. Price cuts are modest; competition is about service quality (slots, ETAs, first-attempt success) rather than cents.

· Seasonal resets. After Christmas, prices ease in Q1—a cycle webshops use to stay competitive in slower months.

Finally, weigh this outlook against external factors that can quickly shift the picture: capacity constraints and consumer sentiment. If sentiment weakens, retailers may lean harder on thresholds and targeted incentives.

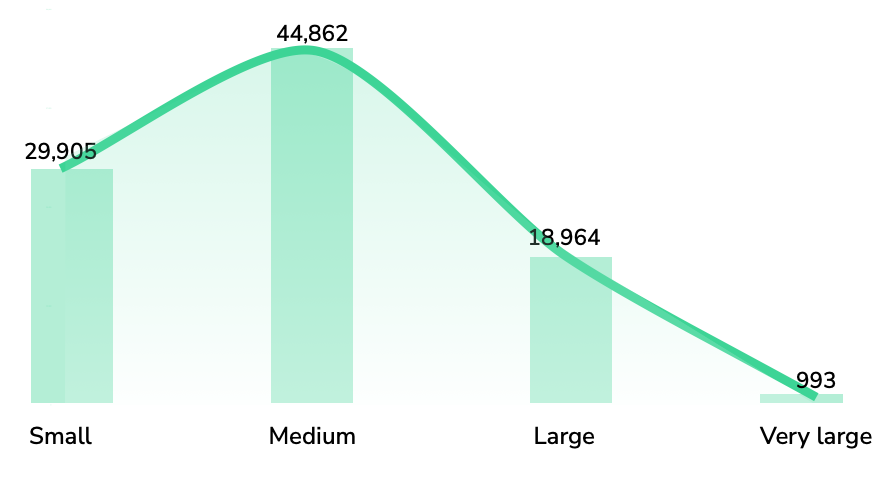

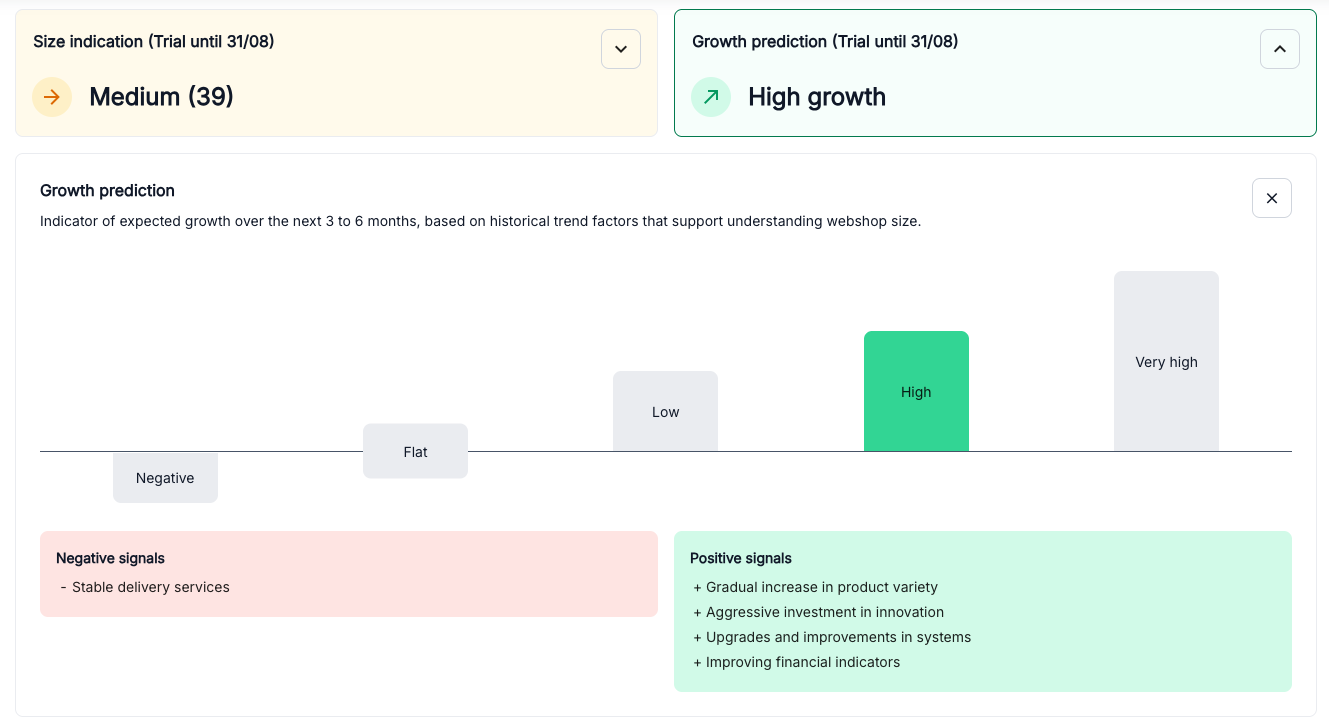

For most companies, two questions matter when looking at the e-commerce market: which webshops will grow and how large they are today. These are not easy to answer. Financial accounts are published once a year and often with long delays. Website traffic tools vary in accuracy. Sales input can be useful, but it is not consistent across markets.

Tembi approaches the problem differently. We track over 800.000 webshops in 22 European markets, visiting them every two weeks, and we convert that activity into a clear view of current size and likely growth.

From this data, we produce two measures.

Together, these outputs give a comparable and timely view of the market that has not been available before.

What makes this possible is the breadth of signals we collect. Every webshop is assessed on seven main areas:

It is the combination of these factors, updated every two weeks, that produces a reliable picture of both size and growth.

Older approaches depend on delayed filings, unstable traffic estimates, or anecdotal sales input. They describe the past, not the present. By contrast, Tembi provides a structured, repeatable model that updates with the market itself. A Danish fashion webshop and a Spanish electronics retailer can be measured on the same scale, and shifts in momentum can be detected months before they appear in official reports.

This is not prediction for prediction’s sake. It is about replacing guesswork with evidence that is current, structured and comparable.

Tembi provides a way to see the market as it develops — which webshops are growing, how large they are, and where categories are shifting. It offers the clarity needed to make decisions with confidence, based on how the market is moving today.

Growth predictions and Size estimation are available on all markets Tembi has been active on for more then three months.

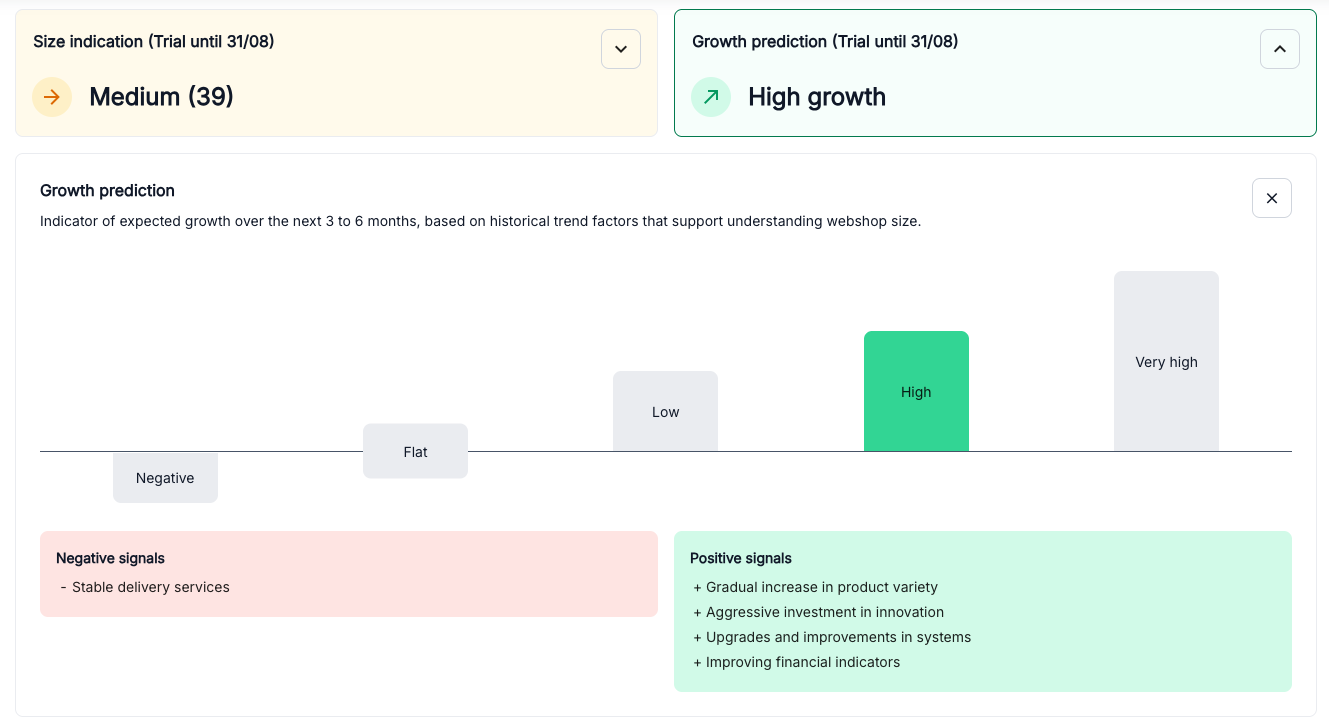

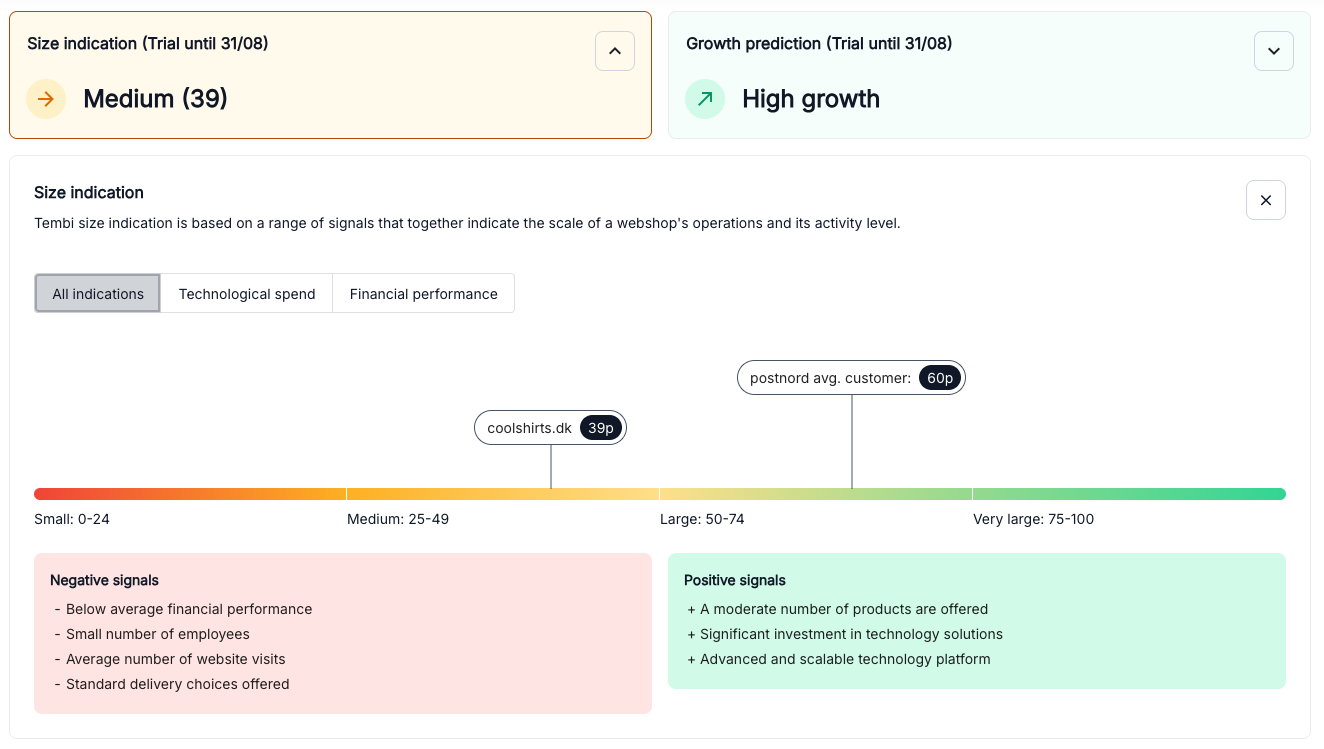

Knowing which webshops to focus on helps your business succeed. That’s why we've launched Tembi’s Size indication, a simple way to quickly understand how active and big (or small) any webshop is in the market compared to the largest online retailers.

What is the Size indication?

Tembi’s Size indications scores webshops from 1 to 100 points, dividing them into clear groups:

This makes it easy to compare webshops and see where they stand compared to others.

How does it work?

The Size indication uses hundreds of data points per webshop to decide each webshop’s score, including:

These factors, and many more, provide a clear picture of how active and large a webshop is. Each webshop’s score is clearly explained, showing both positive and negative factors.

Why the Size indication is useful

The Size indication makes market analysis simpler. You can quickly assess market size and find webshops that fit your ICP. When looking at thousands of prospects, Size indication allows you to sort all webshops, and see their size in relation to each other.

Combine Size indication with Growth Predictions

Tembi’s Size indication works hand-in-hand with our Growth Predictions feature. By combining these insights, you get a complete view of the market opportunity - clearly identifying which webshops are not only large and active but also likely to grow. This powerful combination helps you pinpoint the best opportunities for strategic action and growth.

Want to get started?

Log in to Tembi and check out the Size indication now. All Tembi clients have access to our Growth predictions and Size indication for free during July.

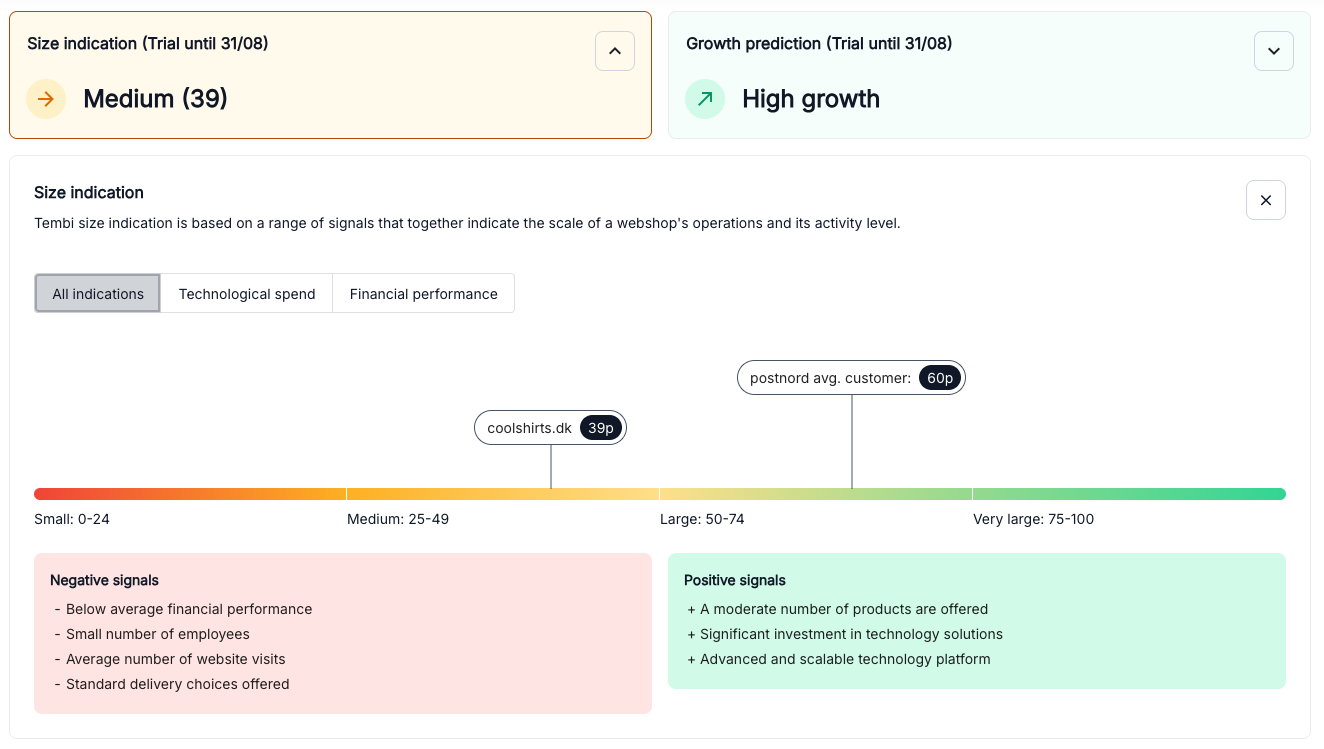

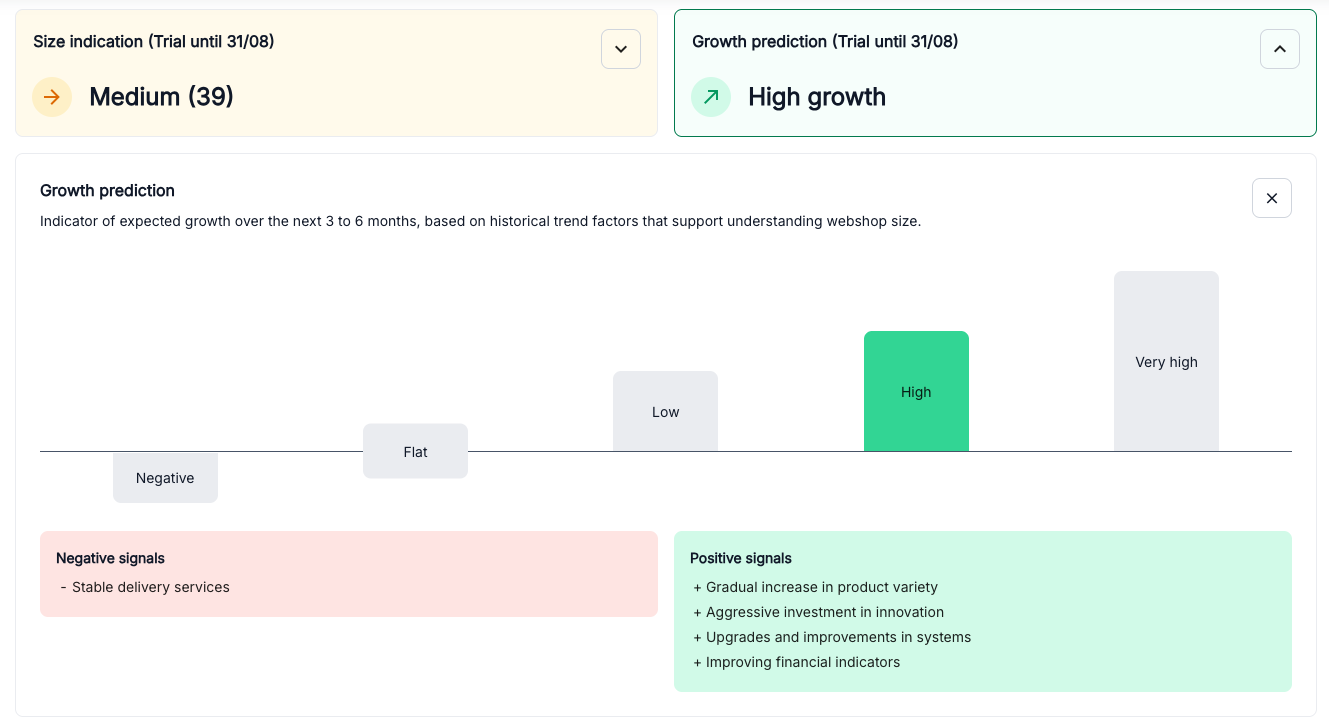

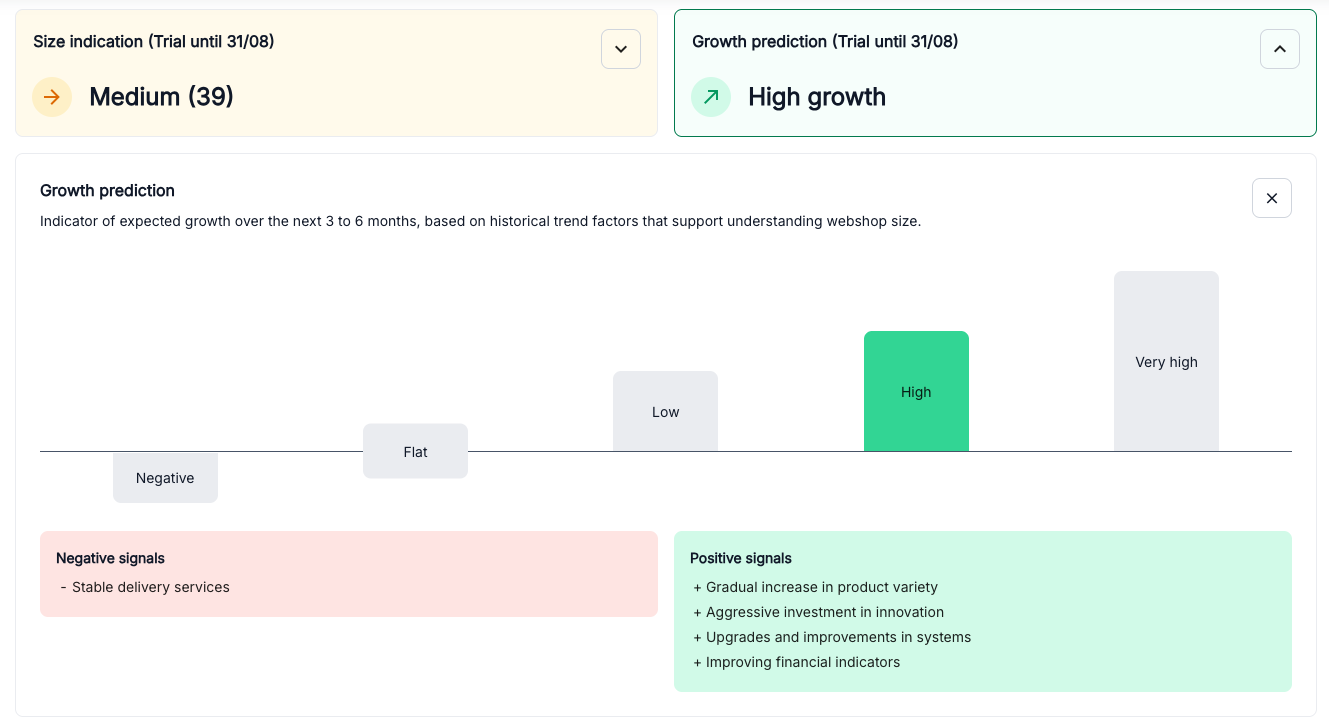

In business, knowledge is power, but foresight is transformational. Until now, most market intelligence relies on delivered reactive insights, offering clarity on the past or present but limited visibility into the future. Today, Tembi changes that by launching a groundbreaking predictive feature for e-commerce: Growth Predictions.

Why predictions matter

Understanding past performance is essential, but knowing what's coming next is where you truly gain a competitive advantage. With Growth Predictions, Tembi analyses hundreds of critical factors across hundreds of thousands of webshops, giving you a clear view of each retailer’s potential growth over the next 3 to 6 months.

How does it work?

Our unique predictive model evaluates comprehensive data points, including:

At the heart of this model is our proprietary AI-powered data collection methodology. For several years, we've meticulously collected, structured, and continuously updated vast datasets. Our advanced machine-learning algorithms use this rich historical data to identify patterns, learn from past behaviours, and generate precise, data-backed predictions. This ensures that our Growth Predictions aren’t guesses - they're calculated insights driven by robust AI techniques.

We translate these complex signals into straightforward, actionable insights, predicting whether a webshop will experience high growth, stability, or potential decline.

Transparent insights for smarter decisions

Growth Predictions don't just give you a simple score. They explain precisely why we anticipate certain growth patterns. For example:

This transparency helps you quickly understand the underlying strengths or vulnerabilities of any webshop.

Transform your commercial strategies

If you’re responsible for partnerships, sales, or logistics, Growth Predictions become your secret weapon. Prioritise your efforts, target the right segments and customers, optimise your resources, and proactively manage your commercial relationships by focusing on webshops that have a higher likeability to succeed.

First of its kind

No other e-commerce intelligence tool provides predictive growth insights at this depth. Using our unique dataset of retailers and product portfolios, we provide a comprehensive mapping of the e-commerce industry, helping companies plan strategically.

We update our dataset bi-weekly, ensuring teams can track prospects, provide insights and get a competitive advantage.

Interested in knowing more, book a demo with one of our experts.

Growth predictions are available for free as an early release during July for all our clients.

The retail industry is in the midst of profound transformation driven by two interconnected forces: the convergence of retail and e-commerce into a hybrid landscape, and the rapid integration of Artificial Intelligence (AI). These forces aren't just altering shopping habits - they're reshaping the entire retail value chain from manufacturing to fulfilment. McKinsey identifies these as key economic game-changers (putting aside broader geopolitical factors).

E-commerce has evolved beyond a simple digital channel into three overlapping segments:

• Manufacturers going Direct-to-Consumer (DTC): Brands like Nike, Zara, and Dyson build direct customer relationships through digital storefronts and direct shipments.

• Pure-Play digital platforms: Born-digital platforms like Zalando and ASOS innovate with personalisation and logistics, with some even branching into physical flagship stores.

• Traditional retailers adopting digital: Giants like IKEA and Walmart are integrating physical and digital experiences seamlessly.

These segments are merging into a highly competitive ecosystem where agility and market intelligence are essential. This blending doesn't simplify competition - it intensifies it, demanding constant vigilance and adaptability.

AI has moved from futuristic concept to operational necessity. Retailers leverage AI for personalised recommendations, dynamic pricing, predictive inventory management, and customer service automation, enabling smarter, faster, and more profitable operations.

Additionally, the expansion of cloud computing and the explosion of available data provide new opportunities to understand market dynamics in real-time. Historically, analysing every shelf in Europe was unthinkable; today, online data combined with AI makes large-scale, real-time market analysis entirely feasible.

A strategic framework for AI-enabled retail

Staying ahead requires a structured approach. Recently, Shish Shridhar from our partner Microsoft shared a strategic framework leveraging real-time data, AI, and automation, highlighting essential levers to drive growth.

Place – Sales channels: physical, digital, hybrid

Product – Assortment depth, availability

Value – Pricing strategy, perceived customer value

People – Customer service, store experience

Communication – Marketing, promotions, loyalty programmes

Systems – Technology infrastructure, analytics, automation

Logistics – Efficient supply chain, fulfilment methods, delivery

Suppliers – Vendor management, sourcing and COGS

At Tembi, we equip retailers and brands with large-scale market analytics derived from real-time data. We continuously track over 600,000 online retailers and 300 million products across Europe - among the largest datasets in the industry. By connecting this data with location specifics, company details, and AI-powered analytics, commercial teams gain clarity and confidence in decision-making, eliminating guesswork when it comes to understanding what drives growth.

As I see it, by unifying data across digital and physical touch points, market intelligence at scale enables smarter decisions in Product, Value, and Systems - helping businesses thrive in a hybrid, AI-first retail world.

• Based on the product categories that you excel in - which markets are then optimal, and in which geographies would it be optimal to promote and sell your products.

• If you have or plan to set up physical stores how are they threatened and compared to online retailers, and how is the specific area you think about investing in evolving. This will show whether you can expect optimal levels for sales per store and store traffic.

• Predict which product categories and brands to invest in, when you decide where to play - which product segments are you in with which brand and pricing strategies to drive market share and inventory turnover and hence sales growth.

• Understand the competition in the product categories and brands you are in and the strengths and strategies of the other players in the market.

Improve out-of stock-rate by finding out when products are sold over the year and if that differs in different geographies, and thereby make sure that availability is secured.

• Understand the current (or seasonality-defined) pricing in the market to increase gross margin, right-in-time markdowns, and possibility for price skimming but get an actual X-ray about the real price development in the market.

• When being present in the market, or especially entering a new one, you need to know how to make it successful. One of the important things to understand delivery market standards in different markets, e.g. OOH, home delivery, free shipping thresholds, delivery time etc. Some D2C try to negotiate a pan-European delivery contract without factoring ion the different market dynamics, or simply enter with the wrong expectations. This quickly becomes very expensive - e.g. if the customers are used to home deliveries and you go in the market wth parcel boxes, you would need to wait for that to be changed. Hence, very important to understand if you model fits to assure fulfilment accuracy.

Success in modern retail isn’t about choosing between physical and digital - it’s about blending them intelligently. In the era defined by AI and hybrid commerce, tools like Tembi provide retailers the crucial insights required to navigate complexity.

Whether you’re a DTC manufacturer, a digital-first retailer expanding your reach, or a traditional retailer enhancing your omnichannel strategy, winning demands strategic clarity grounded in data and real-time market intelligence.

s a real estate professional, you know that timing and information are everything. Identifying which businesses are planning to relocate mean the difference between closing a deal and missing out.

But what if you could predict these moves before they happen?

At Tembi we have developed a solution that gives real estate professional market foresight, and a real competitive edge establishing early client relationships. Our advanced artificial intelligence platform provides you with the ability to anticipate company relocations, transforming the way you secure leads and grow your business.

Traditionally, figuring out which companies are planning to move offices has been a matter of luck or extensive networking and marketing campaigns based on limited data. By the time, a company is ready to look for a new location, or inverse a property hits the market, it is already a race against dozens of other real estate professionals who are also in the know.

At Tembi, we have leveraged artificial intelligence to change the game. Our Real Estate Market Intelligence solution is not just another database – it is a predictive tool that can forecast whether a company will move in the next 6 to 12 months, often before the company itself has identified the need to relocate.

Our proprietary machine learning models analyse vast amounts of data points, from building data and economic trends to company growth patterns, to provide a prediction score on companies likely to move. This insight gives you a significant head start to prepare a proposal, reach out, build a relationship, and maybe even secure a deal before others even know there is an opportunity.

And if you own properties, our Moving Prediction Score is a great tool to health check your current tenants and where they “stand.”

Over time, our machine learning models have become very precise. When we estimate that a company will grow, we are right nine out of ten times , giving it a 90% precision rate. And most companies that will move, we capture.

But we do not just stop at predictions. Tembi provides you with access to comprehensive company data, including size, financial health, and industry segmentation. This information allows you to tailor your approach to each potential client's unique needs and preferences.

With Tembi’s solution, you are not just getting leads; you are getting a consultant's perspective. Understanding the dynamics of the real estate market is crucial, and we give you the knowledge and insights to navigate it effectively. This means you can position yourself strategically in the market and close deals faster, giving you that competitive edge.

Currently, Tembi's Real Estate Market Intelligence is available to real estate professionals operating in Denmark and Sweden, with plans to expand to other markets soon.

Are you interested in getting more information. Please fill out the form below and we will get back to you as soon as possible.

f you knew which company would move within the next six, or twelve months, what would you do with that prediction?

During the last month I have talked with many Real Estate professionals within different sectors in the real estate industry, asking them the question how an understanding of companies moving intentions would change their work and approach. As expected, they all had different answers and saw different possibilities.

Below I have paraphrased three answers that stood out during my conversations.

“As a Real Estate Agent, I would analyze our commercial rental pipeline to identify nearby businesses in the right segment with a high probability of moving. Then reach out to them. But I would also use that knowledge when I try to close potential new clients.”

“Check our tenant status and see if anyone is about to move. The dialogue with our tenants is the most important thing, and this insight will allow me to reach out to them proactively, talk about their journey, and understand if their needs will change soon. So, we can make sure that they will be relocated and stay as tenants with us.”

“Of course, twelve months is a short time frame for us. However, previously, 12 months is far too short for us, but we are experiencing more frequently than before that large companies are not as inclined to commit to leases 24-36 months in advance. In addition to being very interested in understanding how an area is developing and where there will be a need for future offices, we would also use that knowledge to ensure we find tenants for our upcoming projects.”

Predicting if a company will move or not is not science fiction anymore. By continuously collecting and gathering millions of data points, we have at Tembi developed a Moving Prediction Score (MPS) that can predict with over 90% precision if a company will move within the next twelve months. That is about 20 times as good as a random guess.

Using artificial intelligence (AI) and gathering unique data, we can predict how a company will grow, how the number of employees will change and when they would need to move to new offices, as well as understand where they might want to move. Calculating the MPS, we do not only look at historical data, we combine different machine learning models and use this across industries and geographies. Our models are trained on 80 % of the company locations, and we test the models the remaining 20 % to see if we are right or wrong. And that is how we can reach a validated precision of 90%.

If you are interested in hearing more about how our Moving Prediction Score works, or how it can be applied to your business, do not hesitate to reach out to us.

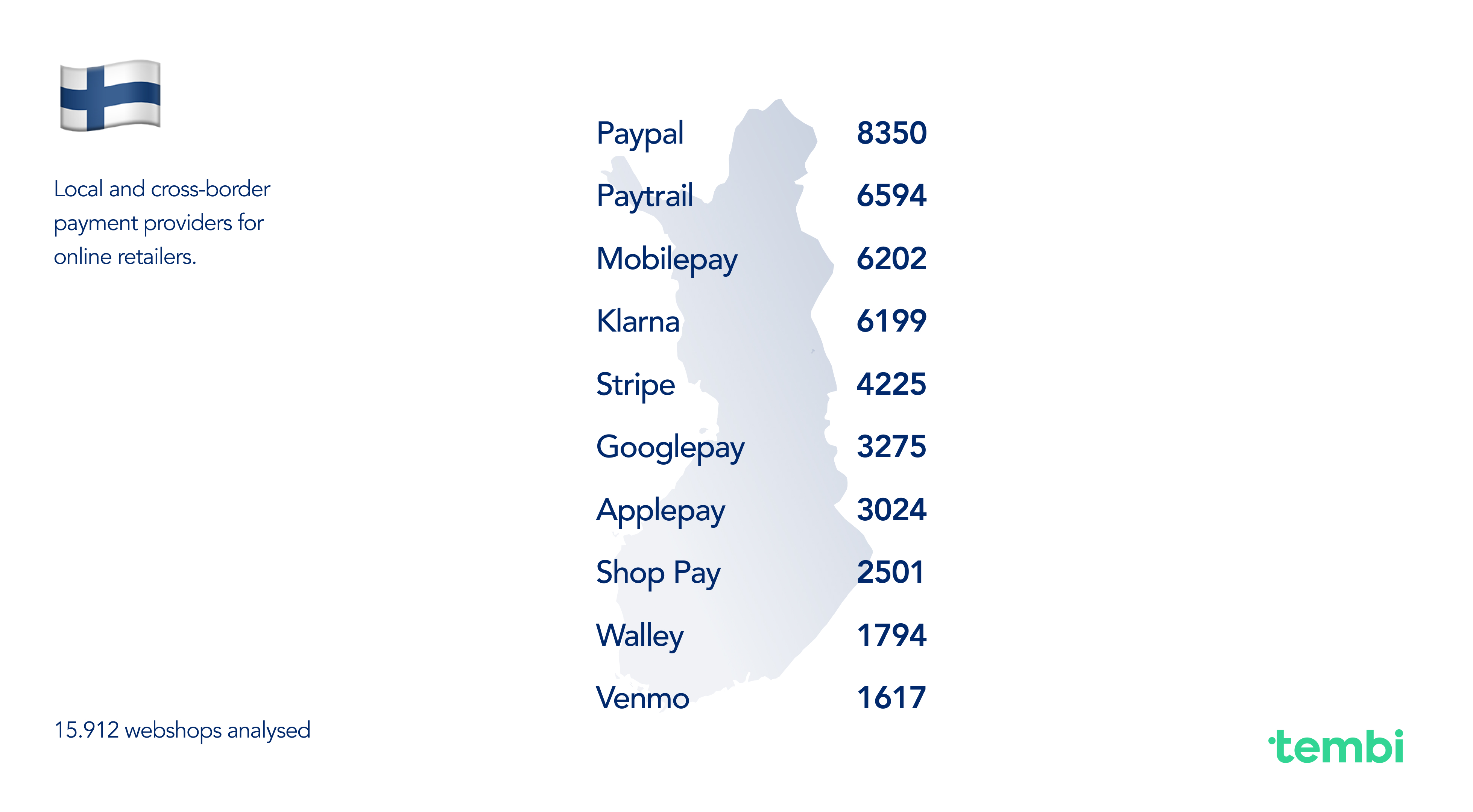

ith our E-commerceMarket Intelligence Report, we have taken a deep dive into the e-commerce industry in Sweden, Finland, Denmark, and Norway to better understand delivery price differences, who are the dominant delivery providers and i.e. which technology providers power all the webshops.

The report is packed with data & insights to give the reader a better understanding of the market as well as the competitive landscape.

The nordic e-commerce is growing fast, with a market size of over €38 billion distributed over 76.000 webshops. Out of the regions 27 million people, more than 19.5million are online shoppers. It's also an exciting place for startups — over the past three months, 4,848 new webshops have opened up online.

All data in this report comes from Tembi’s E-commerce Intelligence Platform (EIP).

We don’t talk about consumer data in this report. We only focus on the businesses in thee-commerce industry, such as webshops, delivery providers, and technology providers.

Type in your details below, and get a version asap in your inbox.

n the fast-paced last-mile delivery sector, market intelligence is essential for success. By understanding your customers, competitors, and market trends, you can make informed decisions that lead to growth and profitability.

Market intelligence can help you identify new market opportunities, improve operational efficiency, and develop new products and services. It can also help you stay ahead of the competition and differentiate yourself from the crowd.

In this blog post, we have outlined a few specific examples of how last-mile delivery companies are using market intelligence to grow their businesses.

Staying ahead of the competition

Market intelligence can help last-mile delivery companies understand the competitive landscape and identify new ways to differentiate themselves. For example, a company might use market intelligence to identify new technologies that can help them improve their delivery services, or to develop new pricing strategies that are more competitive.

Identifying new market opportunities

By tracking market trends and customer behaviour, last-mile delivery companies can identify new markets to expand into or how green delivery is developing. For example, a company might identify a growing demand for same-day delivery in a particular city or region, or an understanding of the competitor's solution and market penetration of different delivery solutions.

Understanding website traffic patterns and consumer purchase behaviour

Last-mile delivery companies can today track which product categories are growing and which webshop’s are growing in popularity, as well as which international sites are exporting to one’s country. By doing so, last-mile delivery companies can establish early partnerships abroad and better equip themselves for future demands and growth.

Developing new products and services

Market intelligence can help last-mile delivery companies understand the needs of their customers and develop new products and services that meet those needs. For example, a company might develop a new service that delivers packages to customers' workplaces, or a possibility to get delivery at very specific times in the evening.

Improving operational efficiency

Market intelligence can help last-mile delivery companies optimise their delivery routes, reduce costs, and improve delivery times. For example, a company might use market intelligence to identify the best locations for new warehouses, or to develop more efficient delivery schedules.

Getting good data for Market Intelligence is not easy, as it requires a lot of time, and quite often a big investment in data infrastructure and a plan to keep high quality and ensure data is actualized. Hence, many decisions are taken without bringing external factors into the mix or using poor data as a ground.

Different Market Intelligence platforms collect different types of data and can help companies better understand the market dynamics. Here are a few tips and suppliers for getting started with market intelligence.

As with any strategic decision, starting the process, you need to define your goals. Market intelligence is not an answer, it is a tool. Are you looking for growth within a particular type of webshops, or price development of different delivery methods? Or a more complex question around identify new market opportunities. Once you know your goals, you can start to identify the data and insights you need.

Collect data

There are many different sources of market intelligence data, including customer surveys, industry reports, and government statistics. You can also collect data from your own internal systems, such as sales data and customer feedback.

Analyse the data

Once you have collected data, you need to analyse it to identify trends and insights. You can use a variety of tools and techniques to analyze data, such as data analytics software or more advanced methods using machine learning.

Share the insights

Once you have gained insights from your market intelligence data, you should to share them with your team to gather input, feedback, and get new ideas so you can keep iterating your work. You can either do a presentation or set up a dashboard that monitors the data and actualises your insights.

Our E-commerce Intelligence Platform – EIP – monitors every webshop on the market, and provides data around providers, prices, and delivery methods. This data can be filtered from a webshop category perspective or for example revenue, providing a comprehensive overview and intelligence of the market and competitors. Hence, EIP both collects and analyses the data, and provides (shares) the insights in simple overview. In other words, decision-ready intelligence.

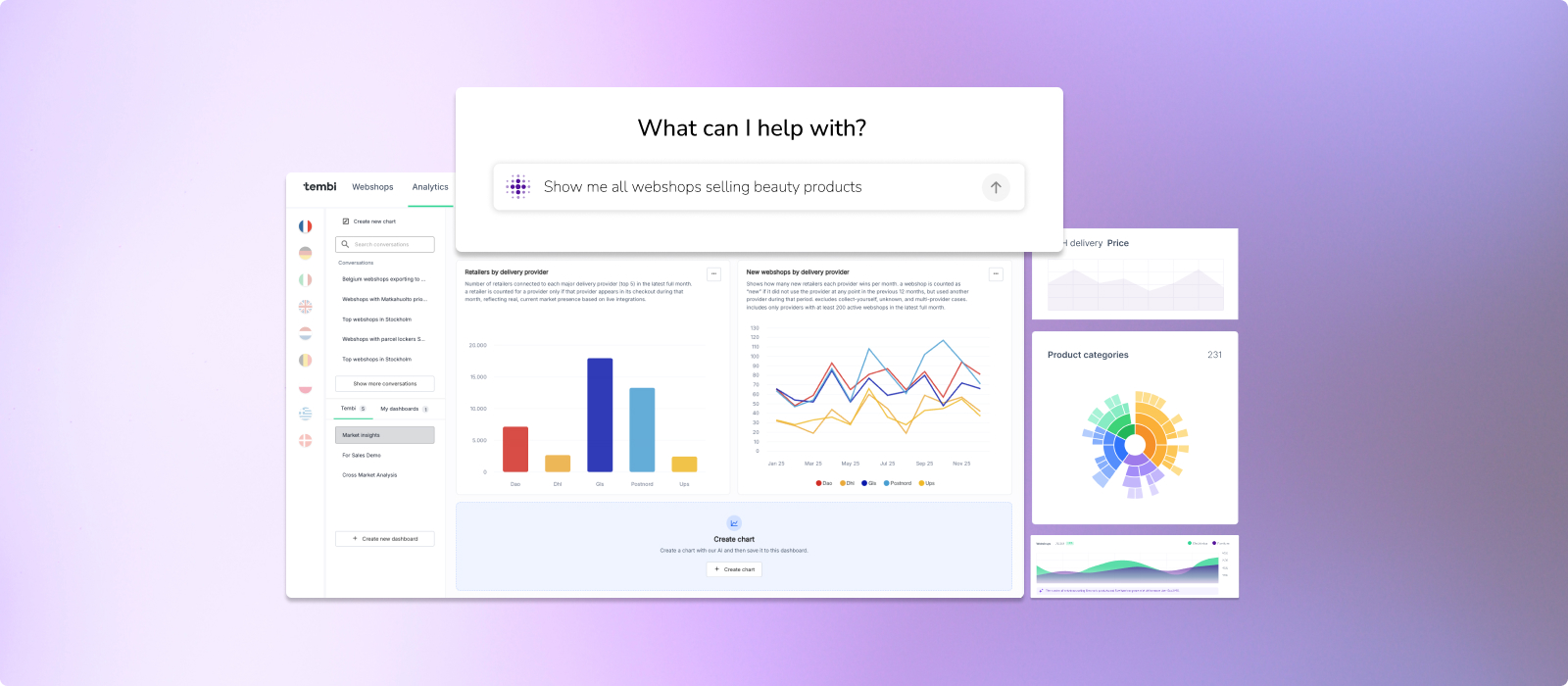

ith the E-commerce Intelligence Platform (EIP), we have set out on one of our most ambitious data and analytics ventures yet: to authenticate and catalog every webshop globally, defining product categories, individual products, and the delivery infrastructure. Our aim is to build the most expansive and current e-commerce database, one that can proactively empower webshops, carriers & delivery providers, and suppliers to navigate through the dynamic, ever-expanding market.

EIP was first introduced in Denmark in 2021 and has since extended its reach to Sweden, Norway, Finland, the Netherlands, Latvia, Lithuania, and Estonia. To date, we systematically and repeatedly index, validate and analyze over 200,000 webshops, classifying them into different product categories.

So, why embark on this colossal task?

The objective behind EIP is to provide the industry with unparalleled Market Intelligence. To achieve this, it was imperative for us to go beyond the surface-level offerings and gain a deep understanding of the last-mile delivery mechanics, the various providers involved, and the pricing structures.

All webshops in one place

EIP offers a comprehensive market overview, identifying and validating every operational webshop, while discarding inactive ones. We have established a direct link between each webshop and its owner, detailing ownership, headquarters, and financial figures. By evaluating the webshops' offerings and categorizing their products, we understand the technological platforms utilized and the delivery services provided, including pricing and export capabilities.

Our "Market Scrape" equips users with a detailed snapshot of all webshops in a specific market. For deeper insights, particularly into the largest, custom-built webshops, our "Custom Scrape" service offers an in-depth analysis.

Checkout monitoring

Understanding the last-mile market, we monitor each delivery checkout on all webshops, gathering information about providers and their position on the list of delivery options, delivery methods and prices, free-delivery threshold, and green delivery options – giving us comprehensive view of the shipping market and how it evolves from a public perspective.

We keep a pulse on the last-mile delivery market by continuously monitoring checkout processes across webshops. This monitoring captures data on delivery providers, their ranking in delivery options, pricing strategies, thresholds for free delivery, and eco-friendly shipping options, thereby offering an overview of the evolving shipping landscape.

Decision-ready Market Intelligence

Merging our data with metrics like order volumes allows last-mile delivery providers to proactively respond to changes in their checkout positioning, preventing potential revenue drops.

“Prior to Tembi, identifying a lost position at a store’s checkout could take up to six weeks, during which we would lose about 64% of order volumes. With EIP's immediate updates, we can swiftly address the issue, preventing significant revenue losses”

Webshop integration manager

Let us say you charge €3,0 per delivered package and expect 100 packages per day (on average). The daily revenue is €300. Losing 64% of the volume equals to a loss of €192 per day. During six weeks that loss amounts to €8.064.

With EIP, as soon as a positioned is lost, you are notified, and can talk to the store, and manage your delivery operations immediately.

From a strategic perspective, both as a webshop owner, as well as delivery provider, you can track which delivery methods are popular, what are the market prices, and where is the market developing, both on your own market, but also abroad.

Automated lead generation

Understanding the supplier network of providers for webshops within different fields - delivery, payments, and technology - opens an overview of who works with whom. Giving providers competitive intelligence and a perfect data set for lead generation and prospecting.

As a delivery provider, being able to see all your clients in one simple overview with metadata, you will equally see where you are not present. By understanding previous relationships and solutions used, you can improve your sales pitch and competitive edge.

There are multiple ways to use EIP and the data. Here are a couple of examples.

EIP for Account Managers

See what technologies your clients are using, and which providers they work with. If you work with last-mile delivery, you can see your position in each check-out and follow your client's business and get the latest data before your check-up.

EIP for prospecting

Whether you work with professional services for webshops or selling software, you can find each webshop on your market and find precisely the type of webshop you are looking for with our filters.

EIP for Business Development

See and follow market trends, track your competitors and always be up to date.

EIP for Customer Success

From the moment you have a new client, follow the implementation and results. Track critical changes and get access to detailed customer business information.

EIP for Analysts and Business Intelligence

Via our API you can extract all our data to your own system and combine external data with your internal data to track correlations, get a full competitor, and market overview.

“A dynamic market requires ongoing data collection.”

Christian Mejlvang, head of product at Tembi

Our data foundation is robust, encompassing over five billion data points, which include both real-time and historical data collected from 2021. We augment this repository daily with over one million data points to guarantee not only the high quality of our data but its relevance as well.

Utilizing diverse machine learning techniques such as AI (Artificial Intelligence), NLP (Natural Language Processing), LLM, and image recognition, we convert raw data into actionable intelligence, aligning with our commitment to transforming data into insight. This data undergoes a process of enrichment, contextualization, and multi-level automated verification to ensure its integrity. We categorize our data into three tiers of quality—Bronze, Silver, and Gold—and it is only the Gold-standard data that is displayed on the EIP platform, reflecting our dedication to the highest standards of excellence.

Our data acquisition strategy is multifaceted: 1) sourcing open data, 2) procuring datasets from various providers, 3) deploying our proprietary scrapers to gather exclusive data, and 4) generating novel data through analytical methods applied to the data we have. This fourth approach underpins our Predictive Market Intelligence service.

We employ a combination of econometric and predictive machine learning models to create proprietary datasets. These are instrumental in our analysis of market trends and trajectories, providing an innovative perspective on market dynamics.

Interested in knowing more about EIP? Contact us.

here are many “intelligences” in the world of business. Besides the cognitive ability of a business’s staff, it refers to the information that has been gathered, analysed, and presented in a way that is useful for decision-making. It is not just raw data; intelligence is actionable information that provides insight into a particular subject, such as a competitor’s activities or internal business capabilities. "Intelligence" is a multifaceted term that usually denotes a high level of understanding, awareness, or information processing, whether by humans, collectives (like organizations), or technology.

What type of intelligence is needed often depends on what strategic decision you are looking to make, what type of resources you have, and the amount of data. Here are the ten most common ones:

Business Intelligence is a technology-driven process for analysing data, presenting actionable information to help executives, managers, and other corporate end users make informed business decisions. BI encompasses a variety of tools, applications, and methodologies that enable organizations to collect data from internal systems and external sources, prepare it for analysis, develop and run queries against the data, and create reports, dashboards, and data visualizations. This process offers comprehensive business metrics, often in real-time, to support better decision-making. With BI, businesses can focus on data-driven strategies to address weaknesses and capitalize on strengths.

Market Intelligence is the gathering of relevant data about the entirety of a company's market space. It covers broad spectrums such as understanding industry trends, identifying market opportunities, and detailed insights into competitors and customers. This intelligence is crucial for forming market entry strategies, pricing models, business development and sales & marketing initiatives. It aids businesses in anticipating market shifts and consumer needs, enabling proactive rather than reactive strategies. The insight gained from market intelligence informs various strategic decisions, such as market opportunity assessment, market penetration strategy, and market development.

Marketing Intelligence is the practice of collecting data from a variety of sources about the market environment a business operates in. It includes the analysis of consumer behaviour patterns, campaign outreach, and purchase triggers. The focus is to understand the success of marketing efforts and to gauge the sentiment and preferences of current and potential customers. It influences tactical marketing decisions and helps businesses adapt their strategies to better meet consumer expectations, enhance brand loyalty, and optimize return on marketing investment.

Competitive Intelligence refers to the systematic collection and analysis of information about competitors and the competitive environment. CI aims to provide a complete picture of the marketplace and the forces at work within it, encompassing aspects such as competitors' strategies, market developments, new entrants, and technological advancements. Effective CI provides a legal and ethical means to anticipate competitive moves and stay ahead of industry trends, supporting strategic planning and risk management.

Customer Intelligence (CI) is a sophisticated analysis of customer data designed to create comprehensive portraits of ideal customers to better understand and predict their behaviour. It is an advanced step beyond basic customer service, seeking not just to address customer needs but to anticipate them. CI combines demographic and psychographic data with transactional and behavioural insights to paint a detailed picture of current and potential customers. This intelligence helps in personalizing marketing strategies, enhancing customer experiences, and boosting customer loyalty. In the age of big data, companies leverage machine learning and AI (Artificial Intelligence) algorithms to process vast amounts of information, providing a deep dive into customer preferences, pain points, and potential opportunities for cross-selling and up-selling.

Financial Intelligence combines understanding a company's financial health with the savvy to use this data in making robust decisions. It involves the analysis of financial data like cash flow statements, balance sheets, and income statements to grasp a company's financial condition and forecast its future performance. It is not just about number crunching; it also includes reading between the lines of financial statements to identify the underlying performance factors, assessing the company's fiscal policies, and ensuring regulatory compliance. Financial Intelligence helps in capital budgeting, financial planning, and aligning financial goals with corporate strategy.

Operational Intelligence (OI) is the real-time dynamic, business analytics that delivers visibility and insight into data, streaming events, and business operations. OI solutions run query analysis on live feeds and event data to deliver real-time operational insights. It involves understanding and optimizing labour productivity, machinery performance, and other operational sectors. By integrating and analysing data from various operations, businesses can quickly identify and address inefficiencies, ensuring the smooth functioning of processes and supporting continuous improvement.

Sales Intelligence refers to technologies, applications, and practices for the collection, integration, analysis, and presentation of information to help salespeople keep up to date with clients, prospect data, and drive business. It includes a range of activities, such as tracking customer data and interactions, social media monitoring, and sales forecasts. With accurate and insightful sales intelligence, sales teams can enhance their productivity, improve lead generation and conversion rates, and drive increased sales and profitability.

Product Intelligence involves collecting and analysing data concerning one's products and those of competitors. It is pivotal in understanding how a product performs across its lifecycle, which features resonate with customers, and what improvements should be prioritized. This intelligence is crucial for product development, management, and innovation, informing companies about user feedback, product usage patterns, and market demands. By leveraging product intelligence, businesses can tailor their product offerings to better meet customer needs and stay competitive in the market.

Technological Intelligence is the systematic gathering and analysis of information about the technological environment of a business to aid decision-making. It includes tracking trends in technology advancements, research and development within the industry, patent filings, and regulatory changes. With a solid technological intelligence strategy, a company can foresee technological disruptions, identify new business opportunities, innovate, and maintain a competitive edge. This intelligence is vital for strategic planning, particularly in industries where technology evolves rapidly and is a key differentiator.

Many types of intelligences are not exhaustive and often overlap. Businesses typically leverage a combination of these intelligence types to inform various functional and strategic areas within their organizations.

aking a decision is easy but knowing how to make the right decision at the moment of choice, now that is tricky. As the outcomes and consequences are only known after the decision has been made, we try hard to mitigate the risk of making a wrong one.

Like a game of probability, we weigh different information and data, and play out the possible outcomes against each other to narrow down our choices, and, well, make a bet. Given the vast amount of information and data available, gathering the needed and relevant information can be a challenge. For the human mind it is impossible to grasp all inputs and data at once. And it is practically impossible. Additionally, as we learn new information, we may create new connections and gain new insights that open new possibilities. Which often leads to the question, "What if...?"

Lastly, before executing the decision, we weigh our options and evidence, and filter it through the personal and/or corporate value filter. By repeating this process, and adding a decision-review step, we learn how to make better decisions. The more we know, the more experience we have, the better our chances of making the best possible choice. And that is how it has been for the last ten of thousands of years.

While we have evolved our ability to gather and access information with software, and made the analytical part simpler and more accessible, machine-assisted decision making and execution is about to change the decision-making process.

The human brain can process 11 million bits of information per second, but our conscious minds can handle only 40 to 50 bits per second. And while we do not always forget, retrieving the right information at the right time is not straightforward.

Our ability to gather and analyse data is limited by our knowledge, time, and “computational power.” However, if we know what information we need, there are now thousands of tools that can help us gather the data and connect it with other data sources to uncover new insights and patterns.

Predicting the future based on historical patterns is not a complicated science, but rarely a trustworthy one. Machine learning algorithms have increased the accuracy and given us a better foresight of how decisions and events might unfold, making it possible to simulate different scenarios and study decision consequences without having to execute a decision. The possibility of setting up “What-if” scenarios and playing them against each other, pushes us closer of being able to make the right, rational decision.

Building on the previous point about the importance of good data, let us talk about the challenge of data diversity. Machine learning models are only as good as the data they are trained on. If you train a model on a narrow dataset, it will only be able to make predictions that are relevant to that dataset. For example, an automated script writer that is only trained on movies and books written by Quentin Tarantino will always produce scripts that are similar to Tarantino's work. The same thing happens if you run your analytics only based on your company's internal data without considering external data such as market and competitor data.

Powerful and accurate models combine data from a variety of sources to reduce bias, improve generalisation, and identify new patterns and insights. For example, a company that is developing a model to predict customer churn could combine data from its internal CRM system with data from external sources such as social media and customer reviews. This would help the company to identify patterns and insights that it would not be able to see by looking at its internal data alone.

The one type of analytics that will profoundly change our decision-making process, and profoundly change how we work, is prescriptive analytics.

Prescriptive analytics is (currently) the final stage in the analytics spectrum, which includes descriptive, diagnostic, predictive, and prescriptive analytics. Descriptive analytics answers the question "What happened?", diagnostic analytics explain “Why it happened!”, predictive analytics addresses "What might happen?", and prescriptive analytics tackles "What should we do about it?", including all former analytics in its process.

When we make decisions, all these analyses happen naturally in our brain and are part of our decision process. The extent of how much we analyse depends on the time we have, the number of people involved, and the consequences of the decision. If we have little time or the stakes are low, we may make a quick decision with minimal analysis. However, if we have more time or the stakes are high, we will spend more time trying to analyse the situation and considering our (imagined) options.

If we turn to machine-assisted decision making powered by prescriptive analytics many of parts of decision process become automated. Using machine learning, algorithms, and computational modelling, prescriptive analytics provide insights, simulates different scenarios, and suggest actionable steps in response to a predicted outcome or scenario.

For example, in supply chain management, prescriptive analytics might suggest optimal routes for delivery based on predicted weather conditions, anticipated traffic patterns, and historical accident data. Or, in finance, it could recommend investment strategies based on a forecasted economic downturn.

A step-by-step decision-making process includes most commonly these seven parts:

Imagine that you have a data foundation that gathers all your data in one place, both external open data (market, competitors etc.) and internal. You have billions of rows of present and historical data, cleaned, enriched, and contextualised. You are a Business Development Manager at a Last-Mile delivery company, and you are tasked with expanding sales to a new area. Where do you start?

1. Identify the decision

In which geographical area can we increase our revenue the most?

2. Gather information

Where are our competitors present?

What are our competitors' prices?

Where are our terminals?

How much are we today delivering in each area?

What delivery options are the most popular in which area?

What investment will be needed for each area?

Etc.

3. Identify alternatives

All areas and options are listed. Business cases are presented.

4. Weigh the evidence

Alternatives are weighed against each other. Pros and cons are discussed.

5. Choose among the alternatives

Once you have weighed all the evidence, you are ready to select the alternative that seems best for the company. You may even choose a combination of alternatives.

6. Take action

You implement the chosen alternative. It is time for execution.

7. Review the decision

You review the results of the decision and see how your expansion plan is working out and iterate.

With prescriptive intelligence in place, the machine assisted decision-making process is similar, but at the same quite different as the effort lies in the beginning, and not the collection of information. We assume here you have access to a tool that combines market data with internal data.

1. Identify the decision

In which geographical area can we increase our revenue the most?

2. Goal formulation (prompting)

What are the results that you are looking to achieve and through what means. List interesting areas for exploration and factors you think are relevant.

3. Scenario evaluation

Alternatives and scenarios are simulated and presented by the AI describing the steps needed to reach formulated goal. Costs and risks are listed based on data that is available. You have the possibility to deep dive into areas to expand your analysis or follow the recommended path.

4. Weigh the scenarios

Recommendation is weighed against the other scenarios.

5. Scenario implementation

You implement the chosen scenario and measure against milestones and goals set by the AI.

6. Review the chosen scenario

The decision and chosen scenario are evaluated in real time with the AI to ensure ongoing learning and optimisation.

If we look past the fact that much of the decision-making process is automated, we move from hypothetical discussions around outcomes and consequences to an evaluation of the proposed steps to reach the decision and set goal. The proposed scenario is not unbiased and unemotional, it is guiding force explaining how to reach that goal with what is available.

Science fiction?

Prescriptive intelligence is not something we imagine anymore, it is being worked on today, and there are already solutions in the market for specific use cases. Our decision-making process will not only be faster (timewise), but we will also be able to be much more accurate in understanding outcomes and the decisions in between we need to make to reach a certain goal.

If everyone can afford the same tools and have access to the same data, isn't there a risk that we will all pull towards the same goals in our respective fields? Isn’t it all about increasing profit through expansion or decreasing costs?

The chances of that scenario are limited.

Not one company has the same data as another one. We can acquire datasets, predictions, but in the end how we operate, they people we employ, the decision we made, and our assets and business models are not the same. Each company has its own strategy, so even if we all access the same market intelligence, the outcome will be different. But just as generative AI has shown with ChatGPT and Midjourney, the playfield has become much more even.

Market analysis and expensive data is becoming less expensive and available to a larger extent of companies, and not only the big ones.

A general prescriptive analytics platform is still a couple of years in the future. At Tembi, we have built the data foundation for it, and are constantly working on adding new machine learning based prediction and econometric models to create better insights and foresights for our clients based on open data.

While companies have their internal data, we provide extensive access to open data, and ready-to-go-analytics – or market intelligence – that provide actionable insights to the decision-making process. Many of our clients use our API to connect their data with our data to examine and understand (i.e.) volume fluctuations (revenue drivers) with external events, and hence be able to understand how external factors impact their business, mitigate risk, or uncover new business possibilities.

The more we connect the world's Information the better we will understand the future, and the more impact our decisions will have. And that is why we work here at Tembi. Until we provide a general prescriptive intelligence platform for executing successful business decisions, we focus on providing market intelligence that is beyond what can be seen by a person online. We combine data from multiple industries and build market predictions models based on changes across different industries.

n today's data-driven world, the abundance of information and the advancement of analytical tools have sparked a competitive quest for insights. As data becomes more affordable and accessible, the ability to use this data effectively becomes a decisive factor in staying ahead. But having data is one thing; making sense of it to predict the future is quite another. It is a complex task that goes beyond just crunching numbers—it is about weaving together diverse parts of information, both old and new, to form a clear picture of what lies ahead.

This article aims to untangle the concept of Predictive Market Intelligence, demonstrating how it operates and its value in a business context. We will look at how this approach to data can lead to smarter decisions and how it is shaping the way companies move forward.

Predictive Market Intelligence (PMI) stands at the confluence where big data analytics, artificial intelligence, and advanced market research meet. It is the art and science of collecting vast amounts of open data - from (i.e.) market trends, company behaviour, to global economic indicators - and analysing them to forecast future market conditions. The aim of PMI is not only to investigate information based on past market performance – historical data – but to forecast the evolution of markets, specific industries, or companies, by employing diverse analytical methods and algorithms.

Unlike traditional market research, Predictive Market Intelligence is dynamic, constantly refining its insights with a steady stream of real-time data. This process enables businesses to not just interpret the present but also to anticipate and prepare for future market developments, gaining foresight and deepening their understanding of potential future scenarios.

If companies can use Predictive Market Intelligence to gain foresight, can PMI be applied everywhere, or are there particular interesting applications of this approach to market analysis and strategy? Here are a couple of examples:

Retrieving Market Intelligence is a question of gathering data from various sources, organising the gathered data, and applying different technologies to validate, enrich and put the data into context. The last step is to apply different analytical models depending what outcome one is looking for. So, where the first step is about gathering (open) data, the second analytical step is the creation of synthetic data (programmatically generated data).

Each step of the process, from open data to intelligence, uses different technologies. Each plays a unique role and function, but applied together, collectively, these technologies can create incredibly precise projections. Let us dive into a couple of them.

Central to Predictive Market Intelligence is the process of data mining and aggregation. This involves the meticulous gathering of vast volumes of data from a multitude of sources like public information, financial reports, and for example websites. The objective is to amass a comprehensive dataset that encapsulates the diverse aspects of the market and company behaviors. This rich tapestry of data forms the foundation upon which further analysis is built.