Act before the market

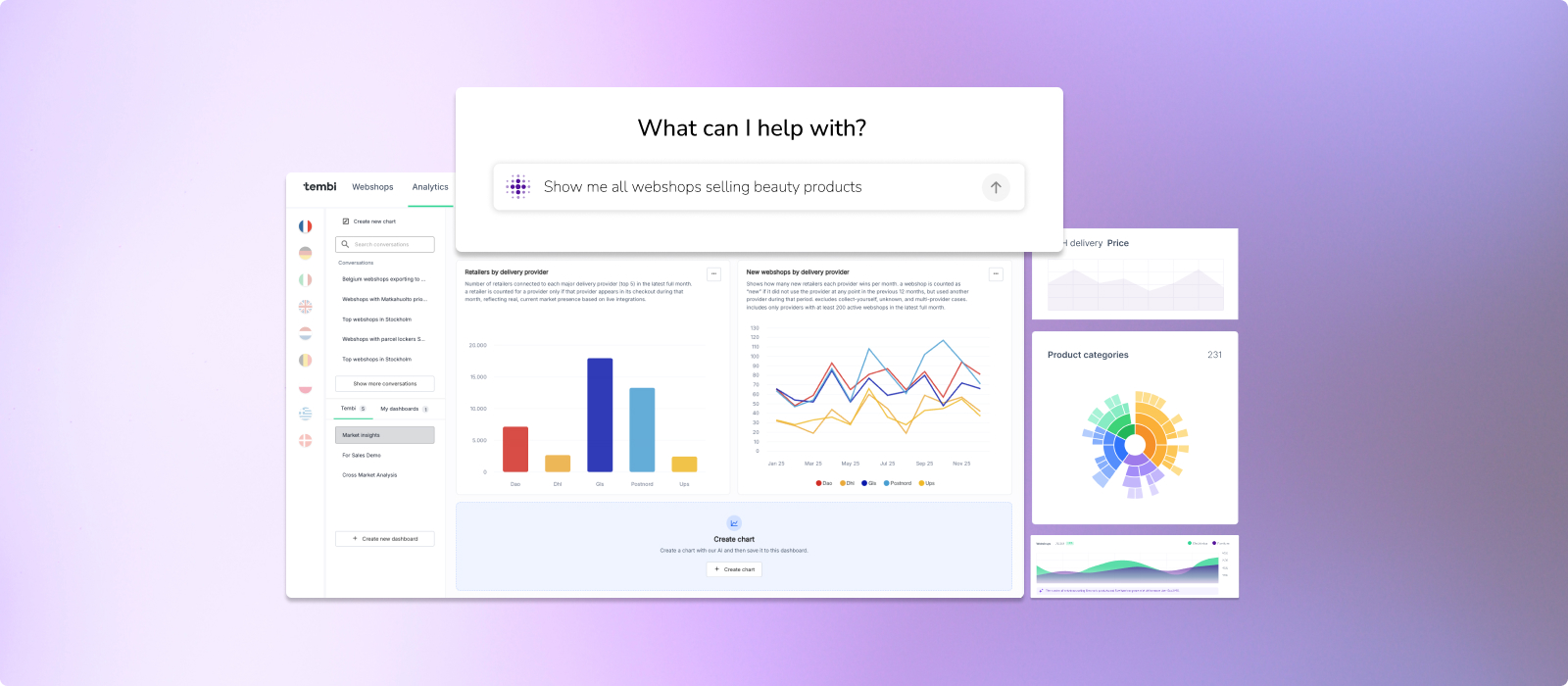

MIA is Tembi’s new agentic Market Intelligence Analyst for e-commerce: an AI-powered analyst that answers complex questions on e-commerce and last-mile delivery by analysing Tembi’s proprietary data from more than one million monitored webshops across Europe. It is built for commercial, strategy and product teams who need to see how markets, competitors and propositions are changing, without waiting for bespoke reports or building complex queries.

MIA turns Tembi’s market-scale e-commerce and last-mile data into something teams can interrogate in real time, not just receive in periodic reports. Instead of working around fixed dashboards, commercial, strategy and product teams can ask complex questions directly and see how markets, competitors and propositions are actually moving across Europe.

A typical workflow might start from a broad question like “Where have delivery propositions changed most in the last quarter?” and quickly narrow down to specific markets, segments or retailers. The analysis follows the question as it evolves, rather than forcing the question to fit a predefined view.

MIA acts like a market analyst orchestrated by a set of specialised AI agents that work directly on top of Tembi’s continuously monitored dataset of more than one million webshops across 23 European markets. When you ask a question, MIA is prompted with your query and an intent understanding agent interprets what you are really asking: the entities involved, the time horizon, the level of detail and the types of comparisons implied.

Based on that intent, MIA calls a data retrieval agent that knows how to navigate Tembi’s proprietary e-commerce and last-mile delivery data, select relevant retailers, markets, time periods and attributes, and assemble a fit-for-purpose dataset for the task. An analysis agent then applies appropriate methods – from simple aggregations and time series comparisons to mix shifts and provider presence views – and turns the results into structured outputs such as charts, graphs and allows users to build multi view dashboards that match the original question.

Throughout this process, MIA keeps the link between the analysis and the underlying data, so every result remains traceable back to specific retailers, webshops and time periods. If you need to validate or challenge a finding, you can move from an aggregate pattern (for example, “delivery options expanding in a given market”) down to the individual webshops that support that conclusion.

MIA follows the way analysts and commercial teams naturally work: start broad, refine, then package the results for others.

Read more about Agentic Analytics

MIA is possible because of Tembi’s underlying data foundation. Tembi continuously monitors more than one million European webshops and revisits each one roughly every two weeks to capture how assortments, brands, delivery methods, checkout setups and other attributes change over time.

That cadence turns e-commerce and last-mile delivery into a moving picture rather than a static snapshot. MIA brings an analyst layer on top of this, so instead of navigating raw complexity, teams can work with focused, question driven analysis that stays anchored in real, current market behaviour.

Explore an analysis of the Italian last-mile market done with MIA.

MIA is rolling out to selected Tembi customers from January 2026, with broader availability planned for March 2026. If your team works with e-commerce or last-mile delivery and wants analyst like access to Tembi’s market-scale data, you can register interest for early access on the MIA product page or by contacting Tembi at hello@tembi.io.

Interested in getting a demo, contact us and we'll set it up.

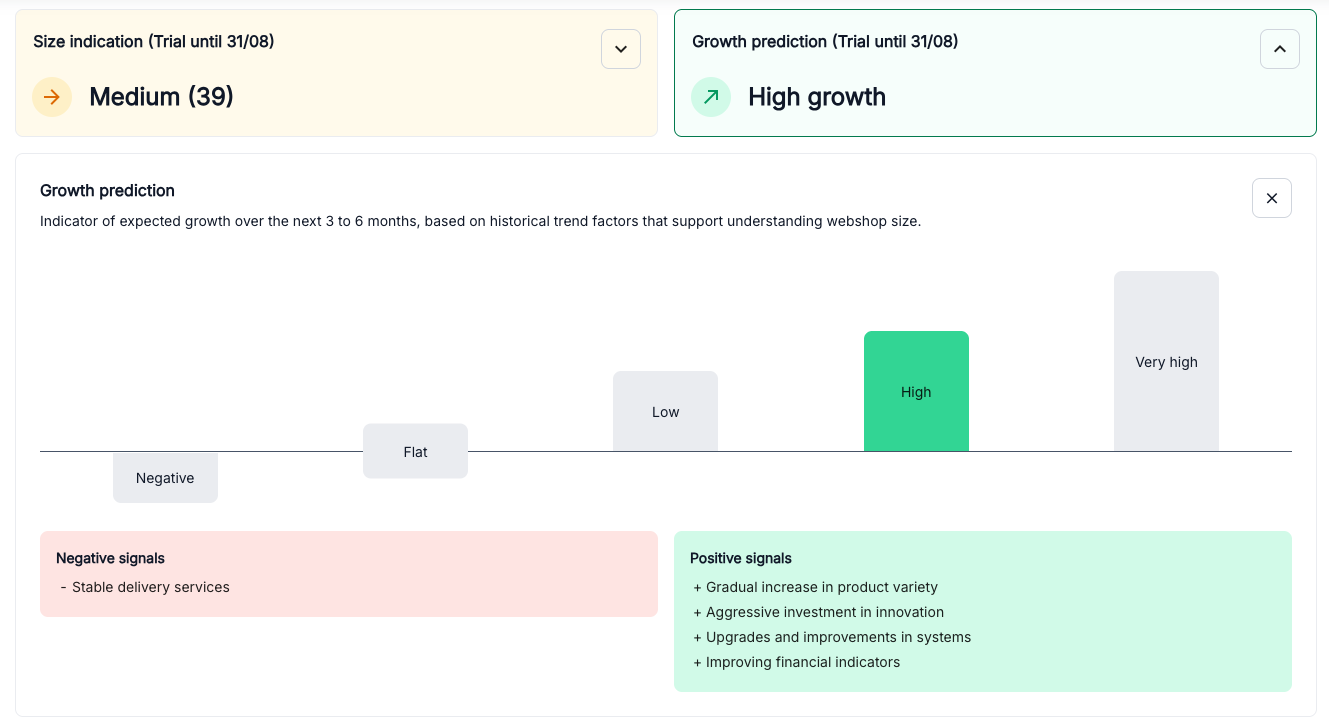

For most companies, two questions matter when looking at the e-commerce market: which webshops will grow and how large they are today. These are not easy to answer. Financial accounts are published once a year and often with long delays. Website traffic tools vary in accuracy. Sales input can be useful, but it is not consistent across markets.

Tembi approaches the problem differently. We track over 800.000 webshops in 22 European markets, visiting them every two weeks, and we convert that activity into a clear view of current size and likely growth.

From this data, we produce two measures.

Together, these outputs give a comparable and timely view of the market that has not been available before.

What makes this possible is the breadth of signals we collect. Every webshop is assessed on seven main areas:

It is the combination of these factors, updated every two weeks, that produces a reliable picture of both size and growth.

Older approaches depend on delayed filings, unstable traffic estimates, or anecdotal sales input. They describe the past, not the present. By contrast, Tembi provides a structured, repeatable model that updates with the market itself. A Danish fashion webshop and a Spanish electronics retailer can be measured on the same scale, and shifts in momentum can be detected months before they appear in official reports.

This is not prediction for prediction’s sake. It is about replacing guesswork with evidence that is current, structured and comparable.

Tembi provides a way to see the market as it develops — which webshops are growing, how large they are, and where categories are shifting. It offers the clarity needed to make decisions with confidence, based on how the market is moving today.

Growth predictions and Size estimation are available on all markets Tembi has been active on for more then three months.

The retail industry is in the midst of profound transformation driven by two interconnected forces: the convergence of retail and e-commerce into a hybrid landscape, and the rapid integration of Artificial Intelligence (AI). These forces aren't just altering shopping habits - they're reshaping the entire retail value chain from manufacturing to fulfilment. McKinsey identifies these as key economic game-changers (putting aside broader geopolitical factors).

E-commerce has evolved beyond a simple digital channel into three overlapping segments:

• Manufacturers going Direct-to-Consumer (DTC): Brands like Nike, Zara, and Dyson build direct customer relationships through digital storefronts and direct shipments.

• Pure-Play digital platforms: Born-digital platforms like Zalando and ASOS innovate with personalisation and logistics, with some even branching into physical flagship stores.

• Traditional retailers adopting digital: Giants like IKEA and Walmart are integrating physical and digital experiences seamlessly.

These segments are merging into a highly competitive ecosystem where agility and market intelligence are essential. This blending doesn't simplify competition - it intensifies it, demanding constant vigilance and adaptability.

AI has moved from futuristic concept to operational necessity. Retailers leverage AI for personalised recommendations, dynamic pricing, predictive inventory management, and customer service automation, enabling smarter, faster, and more profitable operations.

Additionally, the expansion of cloud computing and the explosion of available data provide new opportunities to understand market dynamics in real-time. Historically, analysing every shelf in Europe was unthinkable; today, online data combined with AI makes large-scale, real-time market analysis entirely feasible.

A strategic framework for AI-enabled retail

Staying ahead requires a structured approach. Recently, Shish Shridhar from our partner Microsoft shared a strategic framework leveraging real-time data, AI, and automation, highlighting essential levers to drive growth.

Place – Sales channels: physical, digital, hybrid

Product – Assortment depth, availability

Value – Pricing strategy, perceived customer value

People – Customer service, store experience

Communication – Marketing, promotions, loyalty programmes

Systems – Technology infrastructure, analytics, automation

Logistics – Efficient supply chain, fulfilment methods, delivery

Suppliers – Vendor management, sourcing and COGS

At Tembi, we equip retailers and brands with large-scale market analytics derived from real-time data. We continuously track over 600,000 online retailers and 300 million products across Europe - among the largest datasets in the industry. By connecting this data with location specifics, company details, and AI-powered analytics, commercial teams gain clarity and confidence in decision-making, eliminating guesswork when it comes to understanding what drives growth.

As I see it, by unifying data across digital and physical touch points, market intelligence at scale enables smarter decisions in Product, Value, and Systems - helping businesses thrive in a hybrid, AI-first retail world.

• Based on the product categories that you excel in - which markets are then optimal, and in which geographies would it be optimal to promote and sell your products.

• If you have or plan to set up physical stores how are they threatened and compared to online retailers, and how is the specific area you think about investing in evolving. This will show whether you can expect optimal levels for sales per store and store traffic.

• Predict which product categories and brands to invest in, when you decide where to play - which product segments are you in with which brand and pricing strategies to drive market share and inventory turnover and hence sales growth.

• Understand the competition in the product categories and brands you are in and the strengths and strategies of the other players in the market.

Improve out-of stock-rate by finding out when products are sold over the year and if that differs in different geographies, and thereby make sure that availability is secured.

• Understand the current (or seasonality-defined) pricing in the market to increase gross margin, right-in-time markdowns, and possibility for price skimming but get an actual X-ray about the real price development in the market.

• When being present in the market, or especially entering a new one, you need to know how to make it successful. One of the important things to understand delivery market standards in different markets, e.g. OOH, home delivery, free shipping thresholds, delivery time etc. Some D2C try to negotiate a pan-European delivery contract without factoring ion the different market dynamics, or simply enter with the wrong expectations. This quickly becomes very expensive - e.g. if the customers are used to home deliveries and you go in the market wth parcel boxes, you would need to wait for that to be changed. Hence, very important to understand if you model fits to assure fulfilment accuracy.

Success in modern retail isn’t about choosing between physical and digital - it’s about blending them intelligently. In the era defined by AI and hybrid commerce, tools like Tembi provide retailers the crucial insights required to navigate complexity.

Whether you’re a DTC manufacturer, a digital-first retailer expanding your reach, or a traditional retailer enhancing your omnichannel strategy, winning demands strategic clarity grounded in data and real-time market intelligence.

e’re excited to share that Tembi has officially launched in Germany, bringing our e-commerce intelligence to one of Europe's largest markets. With Germany now on board, Tembi covers 17 markets, offering commercial teams actionable insights to drive strategic decisions and accelerate growth.

At Tembi, our approach goes beyond basic data collection. Over the past month, our system has visited and analysed more than 500,000 websites, systematically verifying each one. Through this process, we identified and validated over 94,800 genuine, operating webshops - ensuring that our insights are based on high-quality, accurate data. Each webshop is individually assessed, capturing detailed insights into their operations, product offerings, and category performance. This level of precision provides commercial teams with unmatched visibility into Germany’s e-commerce landscape, helping them pinpoint exactly where to focus their efforts - whether strengthening their local presence or expanding internationally.

Our robust intelligence monitors the technology stack of webshops, including commerce platforms like Shopify, WooCommerce, Shopware, ePages,AVADA, and Magento, as well as other software solutions they use. This empowers businesses with clear insights to strategically optimise their tech infrastructure and drive growth.

Tembi’s comprehensive analysis of the German market includes:

• Last-mile delivery marketshare - identifying logistics providers, delivery methods and prices for every webshop.

• Tracking of payment providers used by webshops, including PayPal, Klarna, Google Pay, Apple Pay,Sofort, Shopify Pay, ShopPay, and Opay (and many others).

• Webshop growth data andproduct sold, revealing emerging market trends and growth opportunities.

This launch highlights Tembi's dedication to delivering verified, actionable e-commerce intelligence that helps commercial teams proactively identify growth potential and optimise their strategies in Germany and beyond.

Keep an eye out for future updates, insights, and trends straight from Europe's e-commerce hub.

Want to know more? Reach out to our sales team.

In the early 2000s, Open Innovation emerged as a response to the Not-Invented-Here(NIH) Syndrome - a mindset particularly prevalent in engineering and IT organisations.Companies often preferred to build their own solutions rather than adopting existing ones, even when viable alternatives were readily available.

The rise of open innovation, open source, and open data has since accelerated technological progress for everyone. Instead of investing heavily in developing proprietary solutions, businesses can now leverage what already exists, saving time, money, and effort.

Despite these advancements, some businesses still choose to develop their own versions of existing solutions. The reasons often include:

However, these assumptions often lead to inefficiencies and long-term challenges.

If a solution already exists in the market, trying to replicate it internally is rarely the best approach. Here’s why:

Once a company has invested in a proprietary solution, it becomes difficult to abandon, even when it’s no longer efficient. This is how businesses end up with a giant with feet of clay, a fragile system that limits agility and innovation.

Rather than building something from the ground up, focus on what differentiates your business. If a solution already exists in the market, build on top of it rather than duplicating efforts. The key to staying competitive isn’t in owning every piece of technology, it’s in leveraging the best tools available to drive your core business forward.

s we approach the year's final quarter, the stakes for last-mile delivery companies couldn't be higher. With the majority of revenue generated from B2C webshops, Black Friday, Cyber Monday, and the Christmas season represent crucial opportunities to maximise profits.

However, preparation for these peak periods involves more than ramping up staff, fine-tuning routing, and increasing throughput.

At Tembi, having helped over 40 last-mile providers across Europe, we understand that strategic planning on the commercial side can make or break your Q4 performance. To help you in the process we have collected a five of our key learnings on the topic.

Instead of focusing solely on acquiring new clients, ensure you're optimally positioned with your existing ones. Monitoring your position in their checkout process can yield significant returns. Being positioned as the top delivery provider at the delivery checkout can dramatically increase the number of orders you receive, often doubling or even tripling them.

From several of our Last-mile delivery clients, we have witnessed an average of 30%-50% increase in top-1 rankings working tactically with this. Typically, this amounts to a total increase of 20%- 33% in revenue from the existing client base!

Strategic client acquisition is essential. Focus on attracting webshops that boast a strong infrastructure, high order volumes, and the right geographical locations that align with your logistics.

These targeted efforts can significantly enhance your profit margins and operational efficiency.

On the other hand, failing to identify the clients that are right for you means losing time and money on unsuccessful outreach, attending irrelevant meetings, and seeing your closing rate decline. And even worse, potentially attracting a non-profitable client for your business.

Market research or a good market insight & sales intelligence tool will help ensuring you target the right clients. More is not always better.

Understand where you stand out compared to your competitors and highlight your unique selling points to differentiate yourself in a crowded market. Are your delivery times faster? Do you offer more sustainable options? Is your service reliability superior?

Tembi’s E-commerce Market Intelligence solution provides users with a comprehensive, data-driven market overview. This enables last-mile delivery companies to understand their performance and how they measure up against competitors. Our data not only visualises your strengths but also serves as credible evidence of your advantages.

Combining this data with comprehensive insights into each webshop in your market provides a significant advantage in sales meetings. You can tailor your pitch using up-to-date information, demonstrating how your solution will enhance the delivery experience for your customers' clients. This personalised approach showcases the specific benefits and improvements your service offers, making a compelling case for why your company is the best choice.

Q4 is a vulnerable time for webshops, where faulty shipments and slow deliveries can be extremely costly. Success often stems from a partnership approach between webshops and last-mile providers.

Engage deeply with your clients to ensure they see you as a trusted partner they can rely on during these critical periods.

In essence, this is where you want your sales and account management team to spend the majority of their time, which can be enabled by strong processes and the right tools/technologies to help your team be even more efficient.

Effective planning and execution require time, structured outreach, and meticulous account management. There is no easy way. The sooner you start, the better positioned you'll be to capitalise on the high season's opportunities. The time is now – not in October.

At Tembi, we bring years of experience in delivering market insights and partnership services that drive success.

Our market intelligence solutions provide last-mile delivery companies with continuously updated data and insights into webshops, delivery provider rankings, export markets, technology usage, product categories, and much more - allowing companies to react swiftly to changes, maintain top rankings, and increase revenue from their existing client base.

We tailor our supportive services to each client's needs, and we would love nothing more than to set up a free, non-committal session to discover how our e-commerce market intelligence solution could help your business achieve its revenue goals—both in Q4 and throughout the year.

ith Tembi you don’t just get enriched B2B company data, we’ve actually visited every webshop on the market to ensure it is operating, analysed its products to understand what product category it belongs to, and connected traffic data from SimilarWeb to understand how its popularity has developed.

A similar exercise would take 82 years for a person if s/he worked without a pause. And we do it bi-weekly.

At Tembi we are fascinated by the challenge of large-scale data gathering and analytics, and the more complicated, the more creative our product and data science team gets.Our Market Intelligence solution for companies targeting webshops - E-commerce Core – visits bi-weekly any active webshop in the European market capturing data on:

• Technology platform (WooCommerce, Shopify, Magento etc.)

• Payment providers/systems (Klarna, Ayden, Stripe etc.)

• Product data (Products sold, number of products, product growth etc.)

• Company data (Ownership, address, warehouse(s), financial data etc.)

• Operating markets (languages, export markets etc.)

On top of this, we use proprietary AI-models to categoriSe each webshop into a product category using both image recognition and large language models (LLM) to ensure high quality data when you filter our database.

We’ve been there ourselves, looking for that last filter to get a precise search result –why we’ve added over 50 filter options to our product to ensure you can find exactly the webshop you’re looking for. Filter or cross-filter on product categories, growth stage, number of employees, website traffic, number of products, languages –and if you would lack a filter, our team is quick to add it (if we have the data of course).

With deep data on each webshop, we can uncover insights by combining data in different ways. Our econometric and AI-models can today predict revenue estimations, company growth and for example technological investments – adding a deeper understanding of the maturity of a webshops operations.

Combining these insights with webshops data further increases your possibility of narrowing your targeting, as well as better understanding your current clients, or where you’ve had success lately.

With better data, we can get better insights that helps us reach our goals faster. If you’re interested in getting a demo or better understand how our clients use Tembi – don’t hesitate to book a call - or find more material about our E-commerce Core Solution here.

n today’s business world, being data-driven is no longer a question; it is a necessity. Organisations that don’t understand how to work with data and leverage it risk falling behind or even going out of business. However, merely being data-driven is not enough anymore. The rapid growth of access to artificial intelligence (AI) and lowered computing cost has amplified the significance of data, driving a shift towards predictive (and even prescriptive) intelligence to stay ahead of the competition.

Transitioning from a data-driven to an AI-driven organisation presents immense opportunities, enabling companies to understand the competitive landscape better, and leverage both market predictions to gain an edge, as well as improving operations to lower operating expenses. This transition requires a fundamental change in how we operate and organise the company. Secondly, we need to decide where to start, and whether to build, or buy a solution.

Here we share five, simple, steps to ensure your organisations success in this transition.

Achieving success with a transition is a strategic choice and an executional leadership challenge. It is crucial for management, whether top-level executives, business unit leaders, or team managers, to clearly communicate that the goal is to capitalise on the benefits of being data-, AI-, or analytics-driven, and where these benefits will have an impact, and why the transition is imperative for the organisation’s success. Leaders should:

Clarifying responsibility is essential as well as identifying the right person to lead the operational work of the transition. Allocate funding centrally rather than locally to prevent initiatives from being perceived as competing with short-term operational needs. By centralizing funding and clarifying responsibility, organisations can ensure that the transition to an AI-driven approach is viewed as a strategic investment rather than an operational cost.

It is unfortunate when initiatives become confined to a single department or individual. The benefits of an AI-driven approach are significant and extend across the entire organisation. Therefore, it is crucial to integrate solutions into as many teams as possible where there is a business case. Engaging more teams in the adoption phase offers several benefits:

Avoid placing the burden on a single individual. Employ the innovative power of the entire organisation to achieve greater success.

For new solutions and strategies to work, they must be integrated into daily operations. Overcoming existing habits and ways of working requires repetition until the new practices become habits. Incorporate the use of data and analytics tools into the organisational rhythm, such as in weekly meetings or daily stand-ups. Measure the impact of these new practices and share the progress with the entire organisation. Highlight how the transition is improving efficiency compared to previous methods.

Fostering an adaptive mindset is crucial for the transition to an AI-driven organisation. This mindset should infiltrate the company culture, regardless of role. Here are three tips for building a stronger adaptive mindset:

It might sound simple, but actively working on lifting and promoting the right people is very often overlooked. Make sure it is part of the leaderships action plan so this practice doesn’t fall between two chairs, or is forgotten within a couple of quarters.

Building a data and AI-driven organisation is essential for maintaining competitiveness in today’s business environment. Transitioning from being merely data-driven to embracing AI and predictive intelligence offers significant advantages, including a better understanding of the competitive landscape, leveraging market predictions, and improving operational efficiencies.

To ensure success in this transition, organisations should follow five key steps. First, management must clearly articulate that becoming an AI-driven organisation is a strategic goal. This involves transparent communication about the importance and challenges of the transition, along with regular follow-ups and continuous leadership support.

Second, organising the transition is crucial. This includes clarifying responsibilities and centralizing funding to ensure that AI initiatives are viewed as strategic investments rather than operational costs.

Third, disseminating the solution broadly across the organisation is vital. Integrating AI solutions into multiple teams enhances collaboration, shares costs, and accelerates the transition, leading to a higher overall ROI.

Fourth, embedding new solutions into daily routines ensures that these practices become ingrained in the organisation’s operations. Regular use and measurement of the impact help highlight the efficiency improvements over previous methods.

Finally, fostering an adaptive mentality is essential. This involves supporting superusers, hiring individuals with an innovative mindset, and promoting a culture that celebrates successes. An adaptive mentality ensures the organisation remains agile and responsive to new opportunities.

By following these steps, organisations can effectively leverage data and AI, achieving sustained success in an increasingly AI-driven world.

n the ever-evolving landscape of e-commerce, the race to secure customers and meet their delivery expectations has never been more intense. Last-mile delivery providers are constantly seeking new e-commerce clients, but what if I told you that there's a critical factor many overlook? It's not just about acquiring new clients; it's about optimising your position in their checkout process. Here's why:

At Tembi, we understand the significance of where a delivery provider stands in the checkout process. Did you know that up to 60% of final package orders go to the top-ranking delivery provider? This means that by being ranked number 1 instead of 2, 3, or 4 at your clients, you could double or even triple the number of orders from a client.

Interestingly, but not surprisingly, our data shows that the top-ranking delivery provider is the cheapest option in up to 80% of cases.

End-user delivery fees depend on the independent deal between last-mile providers and webshops. Other than lowering the delivery price paid by the e-commerce company, there are several ways to affect this.

Progressive discounts based on order volume, collaborative logistic offerings, reliance on service, and related solutions are all options that can help e-commerce companies offer your last-mile delivery service as the cheaper option for the end user.

However, it's about more than just being the cheapest option. Factors such as delivery time, delivery method, sustainability options, and collaboration with the delivery company also play significant roles. One or more of these are always present when the cheapest option differs from the top-ranked delivery option.

Consumers are increasingly conscious of environmental impact and delivery speed, making these factors crucial in their decision-making process. Therefore, they are also weighed in terms of the webshop owner's priorities and systems.

Losing your top ranking can be disastrous, but it's often discovered too late. Sometimes, you only realise this at the end of a quarter when financial results reflect the drop in orders. It's crucial to act swiftly on changes at your clients.

The Tembi Market Intelligence Solution for e-commerce gives you updated insights into your market's webshops, including delivery providers, checkout rankings, export markets, technology use, product categories, and much more.

This not only enables you to identify new ideal client profiles but also to quickly react to changes in your existing clients – like when you lose or win a top 1 position.

Many of our clients establish a business case for using our market intelligence solution for e-commerce based on new client acquisition alone. However, the value of working strategically and tactically to monitor and react to changes in checkout positions at existing clients often significantly exceeds the value of client acquisitions alone.

From several of our Last-mile delivery clients, we have witnessed an average of 30% - 50% increase in top-1 rankings working tactically with this. Typically, this amounts to a total increase of 20%- 33% in revenue from the existing client base!

Curious to learn more? Eager to get started?

Contact Tembi for a commitment-free discussion about our solutions and services to help you optimise your revenue from your current and future e-commerce clients. With Tembi's market intelligence, you can stay ahead of the competition and secure your position at the top of the checkout page.

In the fast-paced world of e-commerce, every advantage counts. By focusing on client acquisition and optimising your checkout positioning, you can ensure your last-mile delivery business thrives in today's competitive market.

Click here to schedule a call today.

ccess website traffic data inside Tembi.

We are happy to share that we’ve entered into a data partnership with Similarweb where we display monthly website data traffic inside our Market IntelligencePlatform.

Using Tembi, you can now use the data from Similarweb to filter your search based on traffic volumes, see historical data on selected webshops and be able find the growing webshops within different product categories.

For access or inquires, please contact our e-commerce responsible Peter.